Debunking TIPS Tax Inefficiency + A Tax Deferred Alternative

The true tax impact of phantom income plus info on a lesser known alternative to TIPS.

TIPS have a reputation for being less tax efficient than other bonds:

Phantom income is why some investors think TIPS are a tax nightmare. Inflation adjustments make up the majority of return in a TIPS bond. Higher principal values are not realized until the bonds mature. Hence the phantom income name – the tax liability is owed before the income is received.

This keeps TIPS and regular Treasuries on a level playing field. If the inflation adjustment wasn’t taxed until maturity a long-term TIPS bond would offer decades of tax deferral.

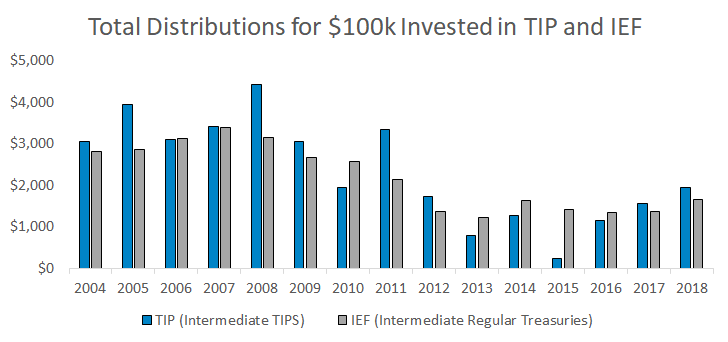

The tax disadvantage is an illusion because TIPS and Treasuries generate similar tax liabilities if realized inflation is equal to expected inflation. The chart below shows the taxable distributions of investing $100,000 at the beginning of each year in intermediate-term TIPS and Treasuries. The higher TIPS distributions in years like 2005 are a result of higher than expected inflation.

Sources and Disclosures

Assumes $100,000 is invested at the start of the year in TIP and IEF and does not reflect reinvested distributions. All returns shown are hypothetical, simulated, and are not an indicator of future results.

Researchers concluded:

“There is not a consistent, sizable difference in the after-tax yields on TIPS versus their fixed-rate counterparts.”Source: Are TIPS Really Tax Disadvantaged?

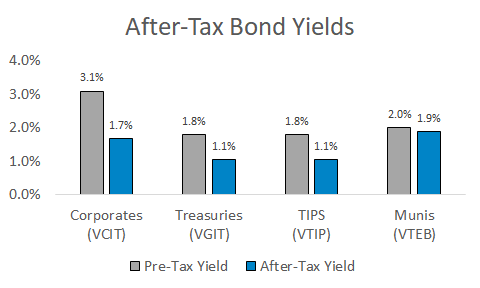

The tax inefficiency argument doesn’t hold water when comparing TIPS to Treasuries, but it is difficult to make the case for substantial allocations to taxable bonds in the taxable accounts of wealthy investors.

The chart below shows pre-tax and after-tax bond yields. The example assumes 37% federal, 5% state, and 3.8% net investment income taxes. Treasuries and TIPS are exempt from state taxes and munis are exempt from federal and net investment income taxes.

Sources and Disclosures

Shows the pre-tax distribution yield for each fund from Vanguard’s website as of July 28.

Series I Bonds: A Compelling Alternative to TIPS

Series I bonds are a lesser known but unique investment option. Main things to know about them:

- Can only be bought directly from the U.S. Treasury

- They earn a fixed interest rate and a variable inflation rate

- Interest accrues monthly and is paid out when the bond is redeemed

- Three months of interest are lost if redeemed before five years

- Zero cost of ownership (no commissions or expense ratios)

- Interest is exempt from state and local taxes

- Interest is exempt from federal taxes if used for education

Most importantly, the interest is not taxable until the bond is redeemed

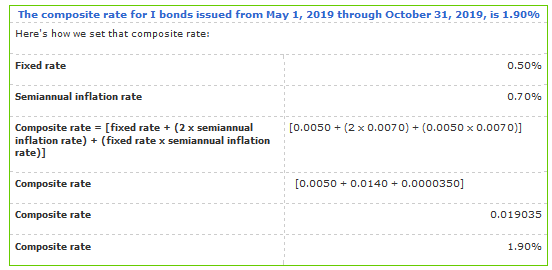

Series I bonds are a more tax efficient version of TIPS. Here’s an example of how the total interest rate is calculated:

The biggest downside is that investors can only buy $10,000 of series I bonds per year.

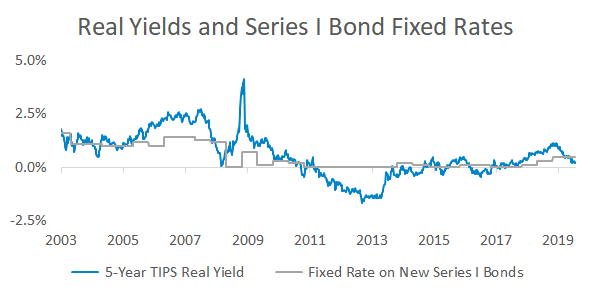

While the inflation rate changes every six months, the fixed rate stays the same for as long as you own the bond. The fixed rate of a series I bond is similar to the real yield of a TIPS bond. The current fixed rate of 0.50% is the highest in nine years and is double the current 5-year TIPS real yield of 0.25%.

Sources and Disclosures

Data for the real yield and fixed rate graph comes from the St. Louis Federal Reserve Economic Database and Treasury Direct. All returns shown are hypothetical, simulated, and are not an indicator of future results.

Summary

- TIPS are not tax disadvantaged relative to other taxable bonds.

- Series I bonds are a more tax efficient version of TIPS and offer an attractive fixed rate until October 31.

This is the fourth in a 5-part series on TIPS. Here are links to the other posts: