Investing Strategy

Resilient portfolios are built with evidence and facts, not emotions and gut feelings. Eversight’s strategy is based on 5 evidence-based investing facts:

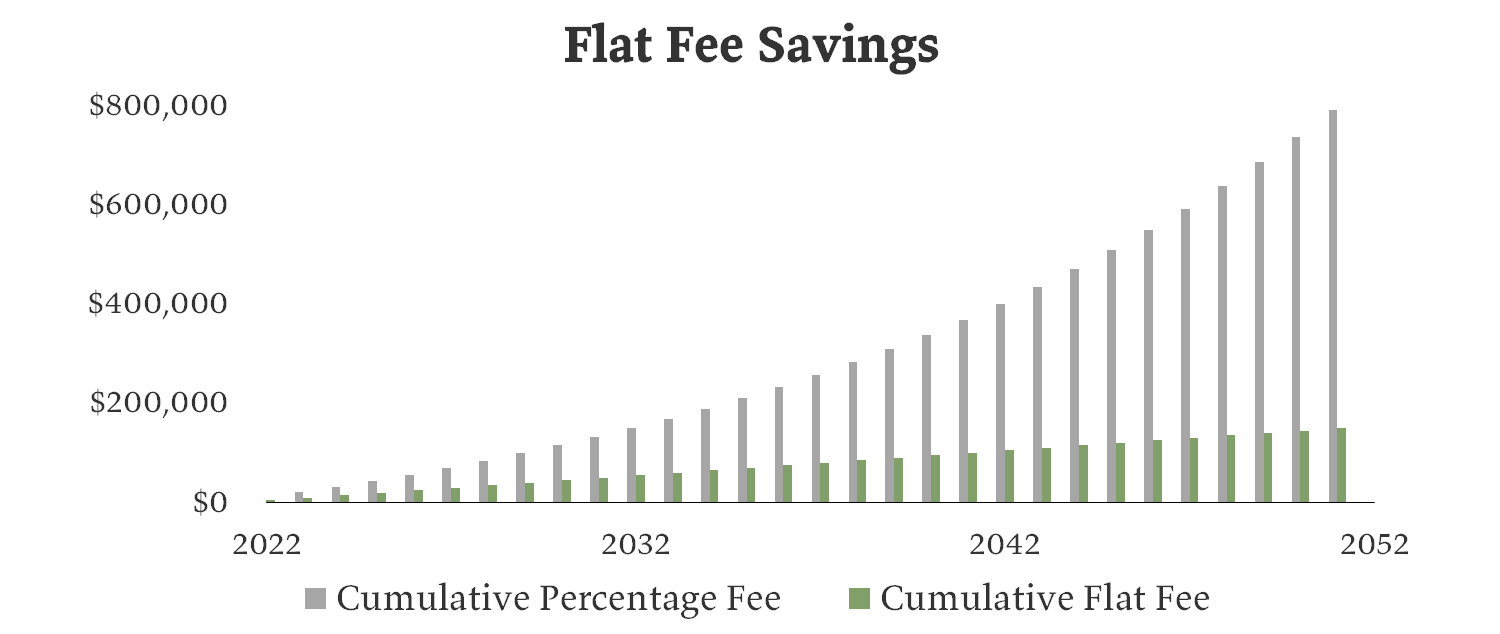

1. Lower fees lead to massive savings

An advisor’s job is to help clients reach their financial goals. High fees make this is an uphill battle.

Consider two hypothetical investors with $1,000,000:

- Both earn 7% per year before fees.

- One investor pays an advisor the typical 1.0% per year.

- The other investor pays an advisor a flat $5,000 per year.

The flat fee investor saved $640,000 in fees over 30 years.

In addition to a flat fee, Eversight uses low-cost funds because research shows that fund fees are the strongest predictor of future returns. The average expense ratio for funds that advisors use is 0.50%. The average expense ratio for funds that Eversight uses is 0.12%.

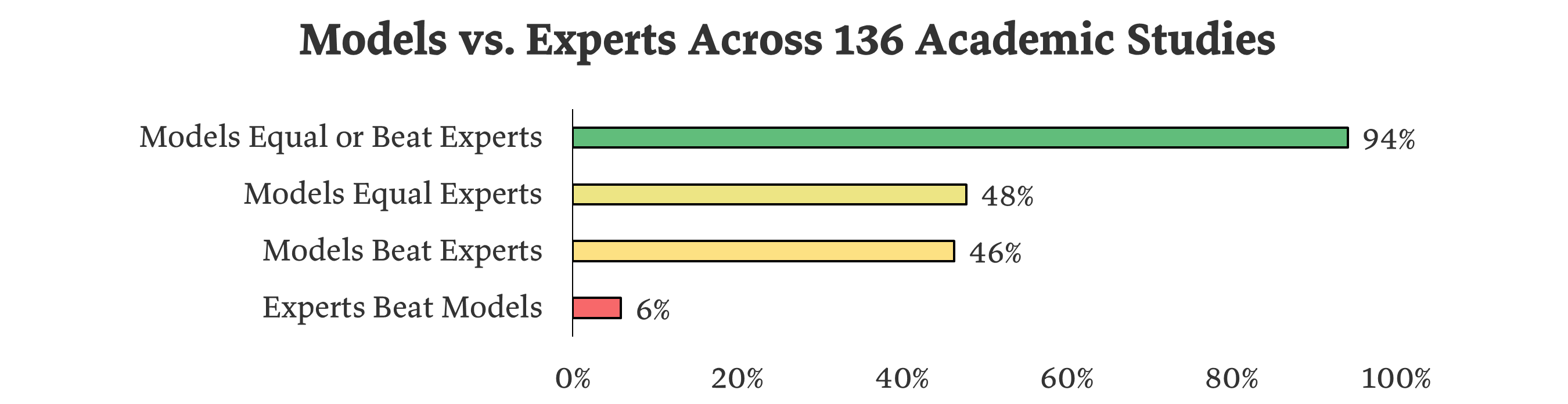

2. Simple models outperform experts

People sometimes have a fight or flight response when faced with a hard decision — not the best mindset for investors. A better approach is making investing with an evidence-based approach (like the page you’re reading).

In a variety of fields, researchers have compared simple models against the forecasting ability of industry experts, with studies ranging from assessing wine quality to estimating the probability of business success. Across 136 academic papers, simple models beat or matched the forecasting ability of experts 94% of the time. Simple models reliably outperform experts because they are not prone to behavioral biases.

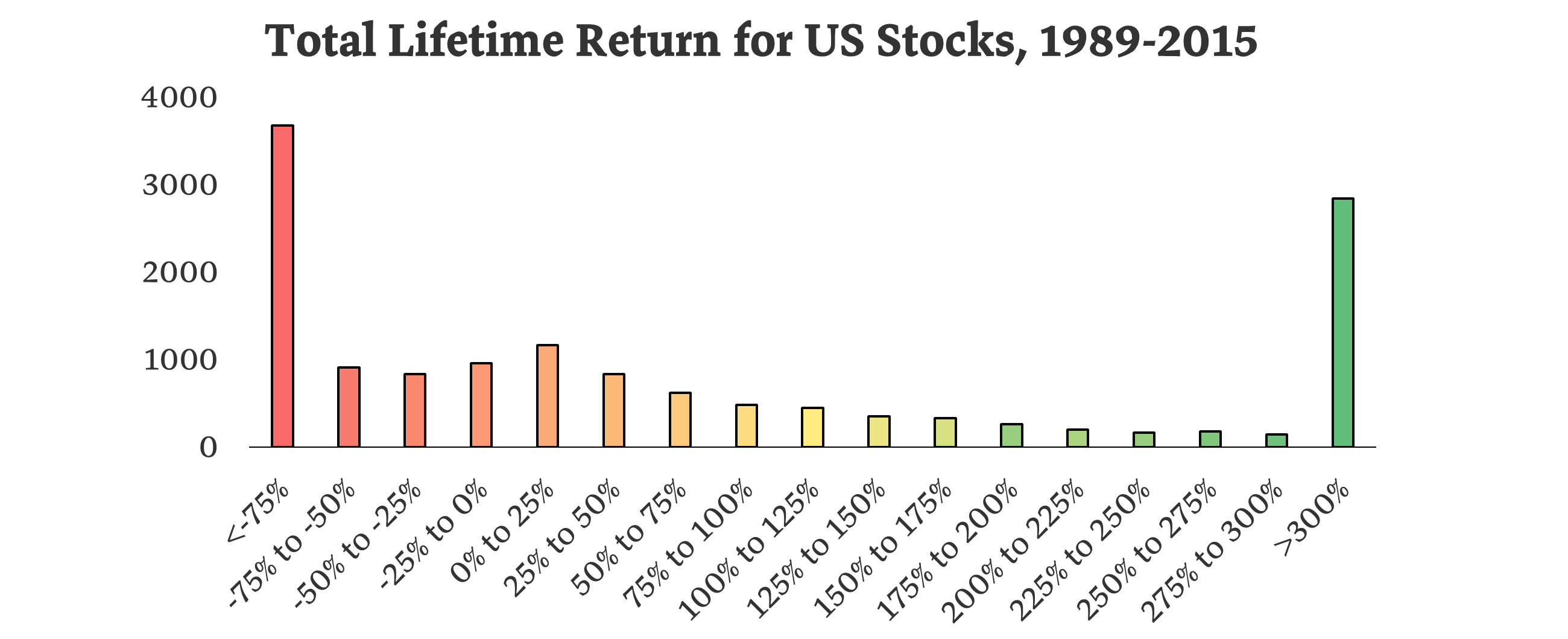

3. Diversification ensures a higher chance of success

A shipbuilder doesn’t build a ship for calm seas — they know that storms happen and build accordingly. Investment portfolios need to be designed in a similar manner: positioned for the best, but prepared for the worst.

Stock market gains are concentrated in a small number of big winners:

The chances of picking these winning individual stocks in advance are slim to none, so it makes sense to diversify.

Diversification can be a frustrating strategy in the short-term because you will frequently lag behind the tough-to-predict top performers. However, a diversified strategy provides a higher probability of long-term success. Eversight uses globally diversified stock and bond funds.

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.” - Charlie Munger

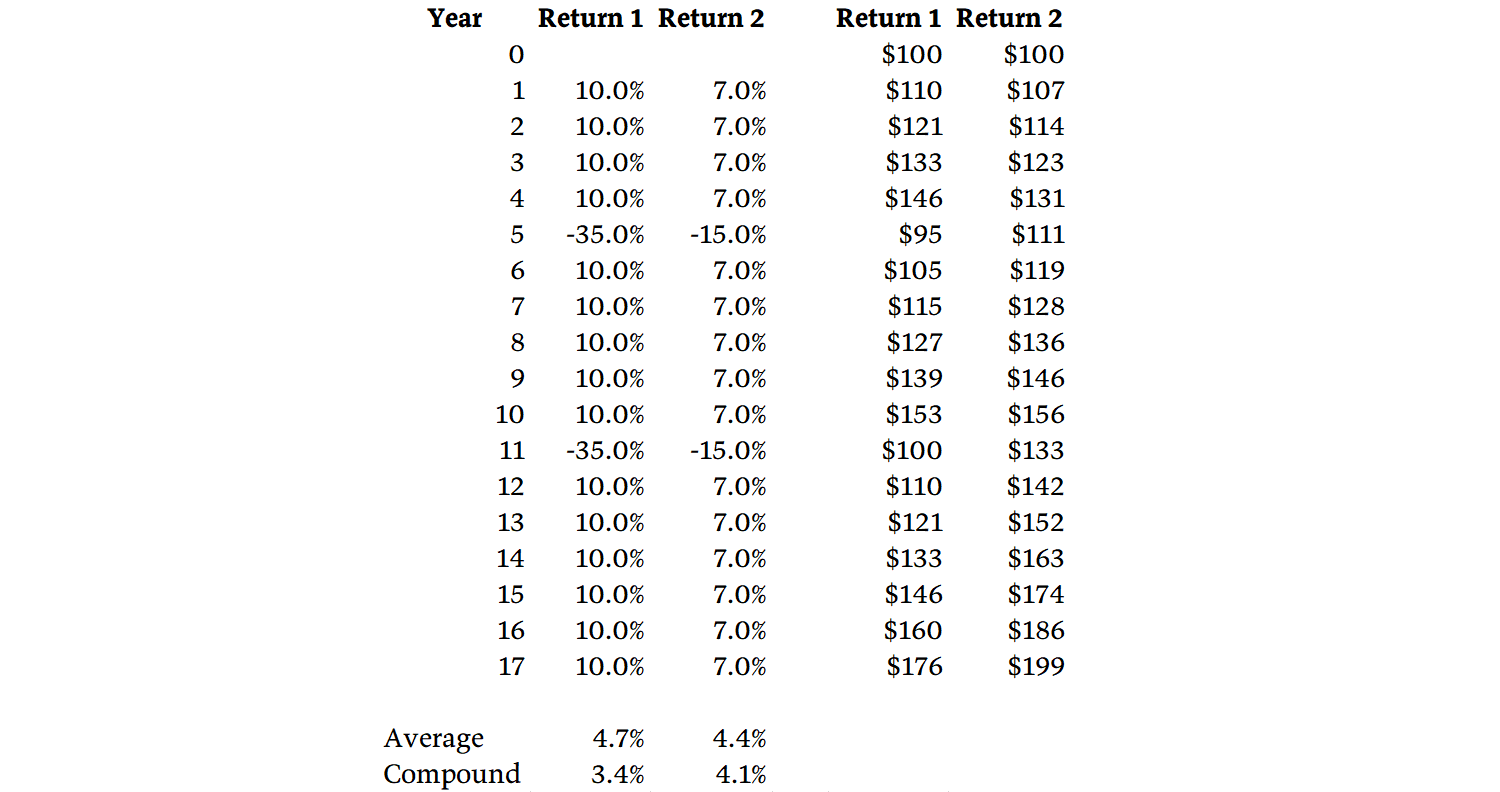

4. Compound returns matter most

The difference between average and compound returns is called the volatility tax. If you lose 10%, it takes 11% to get back to even. If you lose 25%, it takes 33%. There is an asymmetric relationship between losses and the gains necessary to recover.

Consider the two hypothetical investments shown below. One has an average return of 4.7% and the other 4.4%. Most people would guess the first option returned more money, but that’s not the case.

A less volatile return path, despite having a lower average return, can result in higher compound returns. Eversight uses less volatile strategies, like its stock-substitution approach and bond funds with low interest rate risk, to minimize the volatility tax.

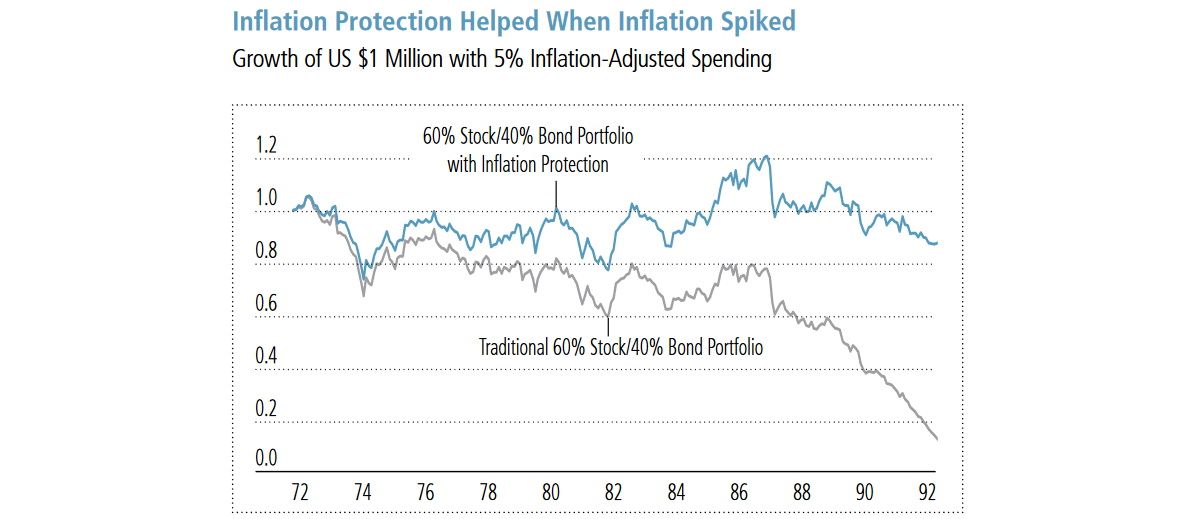

5. High inflation is a risk for traditional portfolios

Imagine you bought a bond in 1968 that paid 5% per year in interest. Inflation was around 3%, so you were making 2% after inflation. During the 1970s, the bond actually lost money, because annual inflation rose to 13%.

Traditional stocks and bonds struggled in the inflationary 1970s, and are just as vulnerable today. Eversight uses inflation-linked bonds and international stocks to protect against inflation.