Small Portfolio Changes Don’t Matter

This post examines the (shockingly small) total portfolio impact of small investment allocations.

Book Summary of Superforecasting

Superforecasting is about how those top forecasters think about the world. Here are my key takeaways of the book.

The True Cost of Hedging S&P Downside

Hedging sounds like a smart thing to do. But has it actually worked? This post examines the historical costs and benefits of hedging stock exposure with SPY puts.

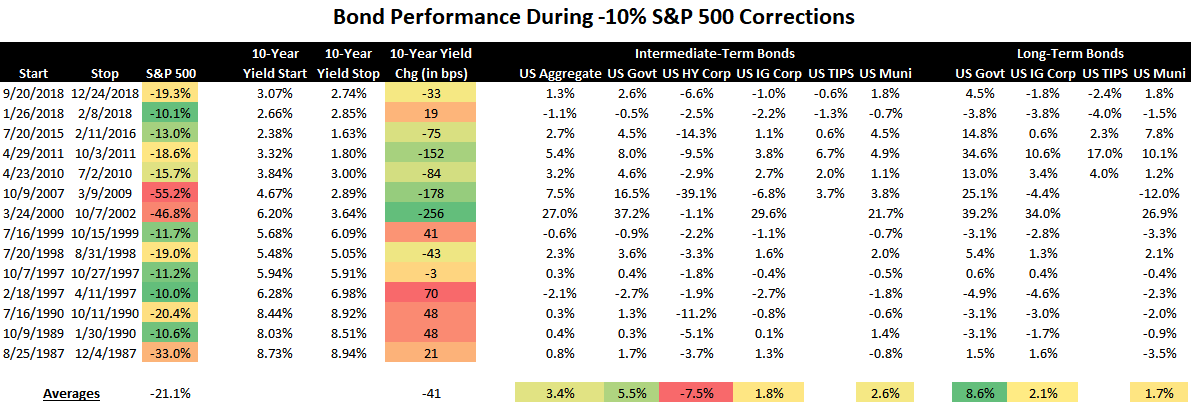

Analyzing Bond Performance in Stock Corrections

The table below shows the performance of bond categories during each -10% S&P 500 drawdown since 1987. VBMFX and BND for US aggregate bonds, FGOVX, VFITX, and VGIT for intermediate-term US government bonds, VWEHX and JNK for intermediate-term US high yield corporate bonds, MFBFX, VFICX, and LQD for

Summarizing the Case for International Stocks

This post answers the “why” and “how much” of international stock exposure.