Original Research

Beware of Financial Alchemy

On the folly of chasing yield, why the stock market isn't a puzzle, and how pattern recognition can backfire.

Is the Permanent Portfolio Broken?

How to fix three major risks of the permanent portfolio.

Measuring the Tax Drag of Trend Following

The goal of this post is to put concrete numbers on the tax impact of trend following strategies in taxable accounts. I tested 12-month and 6-month trend strategies from 1998 to 2019 on three stock index funds: * U.S. stocks with Vanguard’s VTSMX (ETF equivalent is VTI) * International stocks

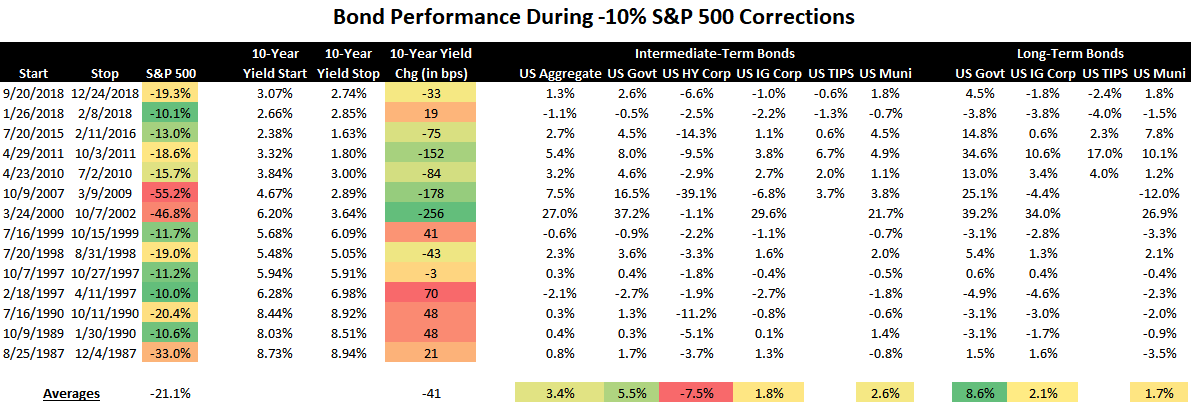

Analyzing Bond Performance in Stock Corrections

The table below shows the performance of bond categories during each -10% S&P 500 drawdown since 1987. VBMFX and BND for US aggregate bonds, FGOVX, VFITX, and VGIT for intermediate-term US government bonds, VWEHX and JNK for intermediate-term US high yield corporate bonds, MFBFX, VFICX, and LQD for