Which Investments Have the Highest Volatility Tax?

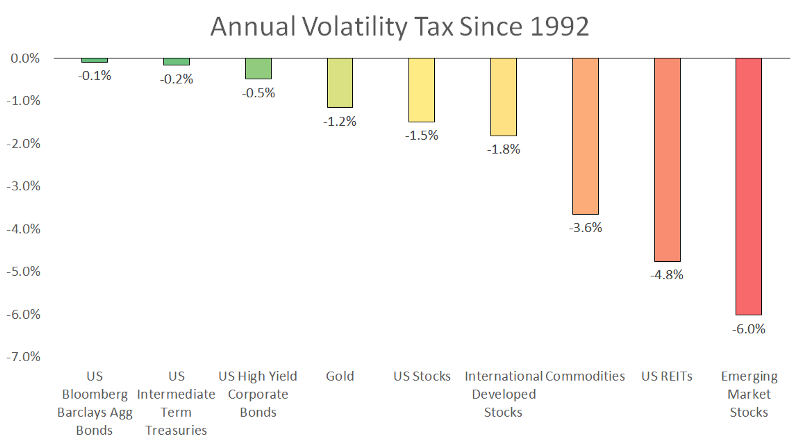

The difference between compound and average returns is called the volatility tax. This post shows the historical volatility tax for major asset classes.

Long-Term Capital Management grew at 30% per year from 1994 to 1997, then dropped 92% in 1998. Investors were effectively wiped out, yet the fund’s historical average annual return is a placid +5.8%.

Investors earn compound returns, not average returns. Compound returns measure the total effect of a long-term return series and are a more accurate metric of investment growth. The difference between compound and average returns is called the “volatility tax”. This post shows the historical volatility tax for major asset classes.

“The volatility tax is the hidden tax on an investment portfolio caused by the negative compounding of large investment losses.” Mark Spitznagel

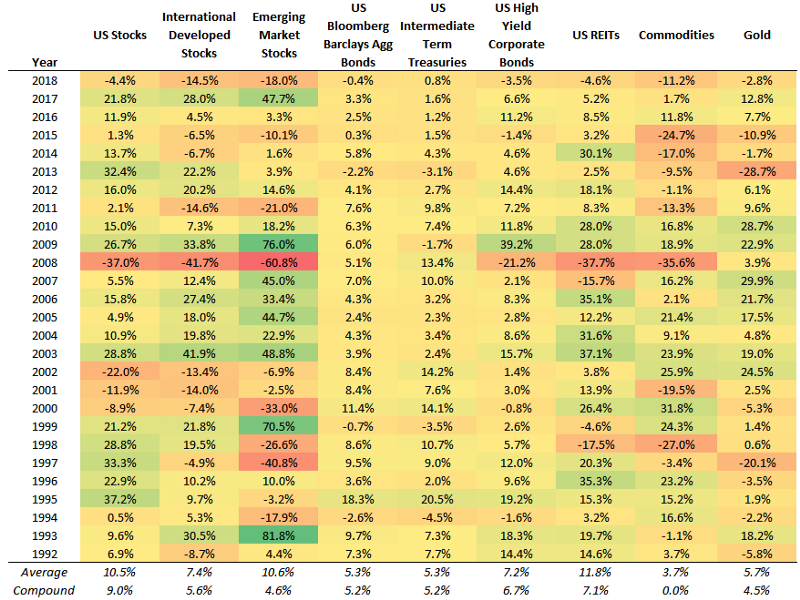

The table below shows annual returns for major asset classes.

Most investments take the stairs up and the elevator down. Particularly bad years increase the volatility tax over time, making it difficult for an asset to get back to its all-time high. For example, U.S. stocks fell 37.0% in 2008. $100 became $63. U.S. stock investors needed to earn 58.7% to get back to even, which was substantially more than the 37.0% loss.

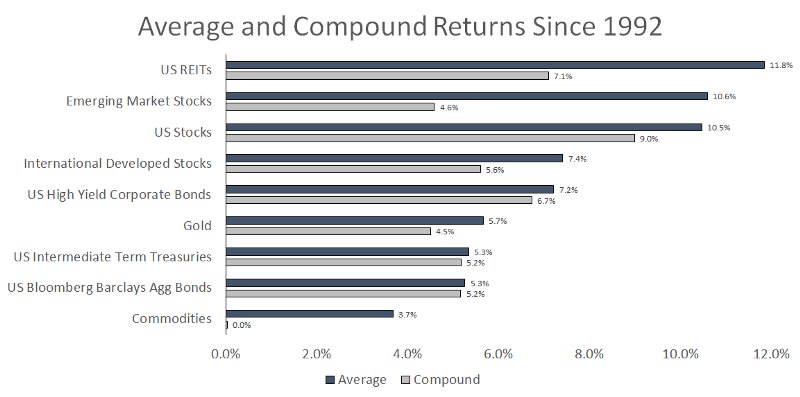

The chart below plots both average and compound returns for each asset.

Emerging market stocks had an average annual return of 10.6% from 1992 to 2018, which at first glance outpaced the 10.5% average return of U.S. stocks. Yet the compound return of emerging market stocks was only 4.6%, meaning they actually underperformed less risky assets – such as government bonds.

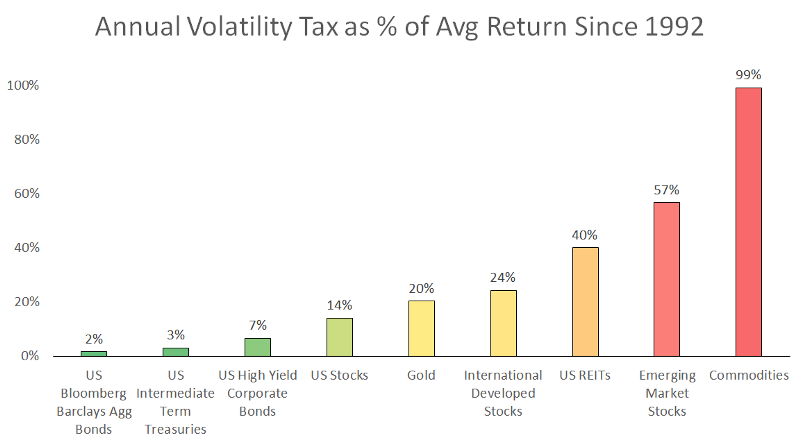

Another way to visualize the volatility tax is to scale it by an asset’s average annual return. For example, the annual volatility tax in commodities of 3.6% wiped out 99% of the average return of 3.7%. In other words, $100 invested in a broad commodity index in 1992 was still $100 in 2018 (likely less after fees).

Summary

This doesn’t mean investors should avoid assets with a historically high volatility tax. Nobody knows which investments will experience a big drawdown in the future. The important takeaway is that the path of investment returns matters. Ideally, investors should pursue the smoothest possible path to reach their financial goals.

The main way to do this, as Warren Buffet says, is “don’t lose money.” Specifically, an investment strategy should be designed to avoid catastrophic losses that derail a portfolio’s long-term compound return.