When High Yield Isn’t High: After-Tax ETF Returns

A look at the true returns of popular ETFs held in taxable accounts.

Investors love anything claiming to be high yield. Mark Dow once said “if it’s got high yield in the fund name that’s good for at least $1 billion in assets.”

For taxable investors, headline yields are an illusion and this post shows after-tax returns for popular high yield ETFs.

High Yield Bonds

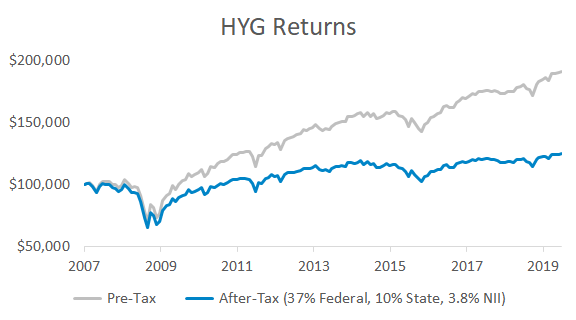

Let’s start with the poster child for high yield ETF investing: HYG, the $18 billion corporate bond fund.

The graphs are based on current rates and assume an investor is in the highest federal bracket and lives in a state with high income taxes.

HYG has compounded at 5% since 2007. After-tax returns have been half of that because corporate bond interest is subject to federal and state tax. A high income investor in a taxable account could have outperformed HYG with much less risk.

Dividend Stocks

As Meb Faber pointed out, dividend investing is like Coke and Ferrari in that it has a great brand.

We’ve all seen charts showing the outperformance of dividend stocks. But this has mainly been because dividend stocks have historically traded at a lower valuation than the overall market. That’s no longer the case.

Dividend investing is a tax-inefficient and diluted form of value investing. Warren Buffett’s Berkshire Hathaway paid one $0.10 dividend in 1967 and Buffett joked, “I must have been in the bathroom when the decision was made.”

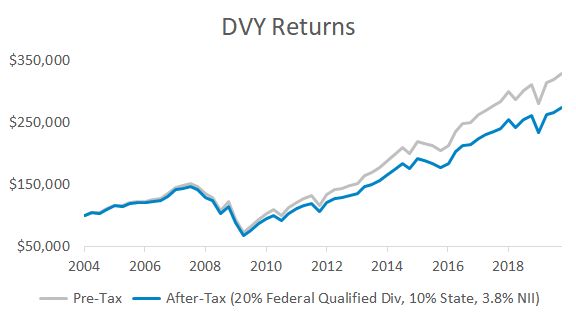

This chart shows returns for DVY, the iShares Select Dividend ETF:

There’s less tax drag than HYG since more of DVY’s return came from capital appreciation. Plus, qualified dividends are taxed at a lower rate than bond income.

Master Limited Partnerships

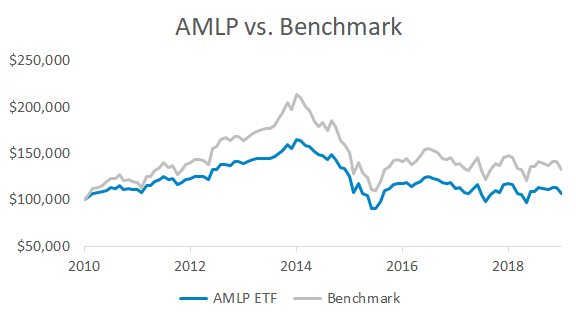

Investors like MLP funds to avoid the K1 tax forms that come from directly owning MLPs.

Swapping individual MLPs for an ETF isn’t a free lunch because C-corp funds have to pay 21% in corporate income tax. This has led to AMLP, the biggest MLP ETF, substantially underperforming its benchmark:

AMLP experienced a 42% drawdown and has returned less than cash since inception.

An 8% yield doesn’t matter if the principal has been a melting ice cube and the fund wrapper takes a fifth of the distribution.

Bonds

The world’s biggest bond funds track the Bloomberg Barclays Aggregate index. These funds mainly own corporate and Treasury bonds and don’t belong in the taxable accounts of high income investors.

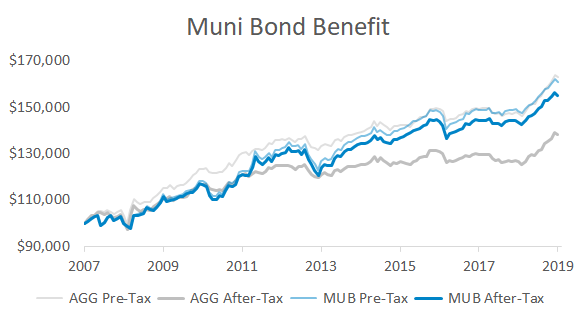

Here are the returns of a fund that tracks this index (grey) compared to a municipal bond fund exempt from federal taxes (blue):

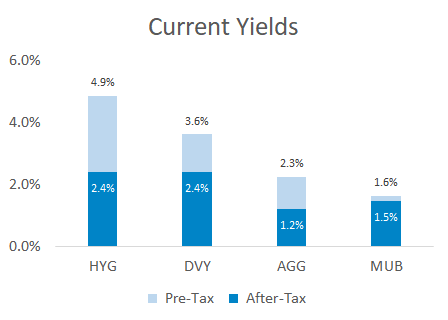

Summarizing the after-tax yields of the above ETFs:

Tax Drag Overview

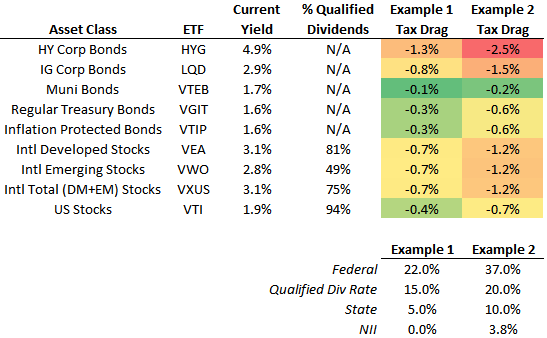

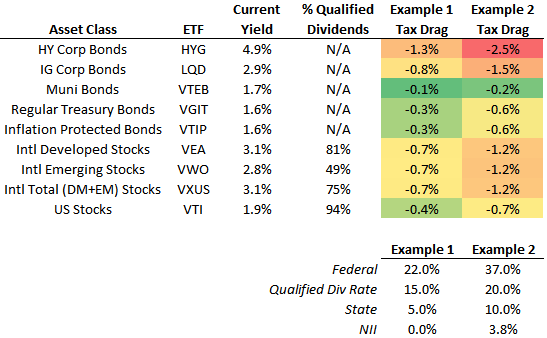

Here’s the annual tax drag on returns for two example investors:

Basically, high income investors should tilt taxable bond exposure to municipal bonds and taxable stock exposure away from dividend strategies. (P.S. you can file for a tax credit to reduce the tax drag of foreign stocks.)

Speaking of tax losses, I should also note the wave of capital gain distributions about to hit investors in actively managed stock mutual funds. Christine Benz at Morningstar has a great article on this.

Summary

- High income investors shouldn’t have large taxable allocations to corporate bonds or high dividend stocks.

- After-tax total returns matter more than headline yields.

- Tax drag is a cost that detracts from returns and should be minimized.