Three Crisis Strategies to Avoid

Don’t fall prey to these three gut instincts during a market meltdown.

These three approaches will lead to poor returns in today’s market:

#1: Only Considering Extreme Scenarios

There are two main schools of thought for the virus and markets:

- Virus: This won’t be worse than the regular flu OR expect millions to die like in 1918.

- Markets: Things will calm down soon OR expect a repeat of 2008.

Extreme viewpoints get traction because news outlets make a living out of freaking us out.

The 2009 H1N1 flu infected roughly a billion people around the world but only killed 12,000 Americans. Not to make light of this number, but you can have a serious flu pandemic without it snowballing into a 1918 scenario.

Investors mentally anchor to 2008 because it’s the most recent recession. Returns in 2008 were an exception, not the rule, to the typical severity (-37%) and duration (~1 year) of a bear market.

#2: Underestimating Portfolio Risk

For stocks, you have to get two things right:

- Sizing: Add up the dollar amount you have in stocks. Cut it in half. Would losing that amount make you throw in the towel? If so, you need to reduce stock exposure.

- Diversification: The two stock funds I use are VTI and VXUS. Each own thousands of individual companies and ensure I’ll avoid the -30% daily down moves like we’ve seen with energy and airline stocks.

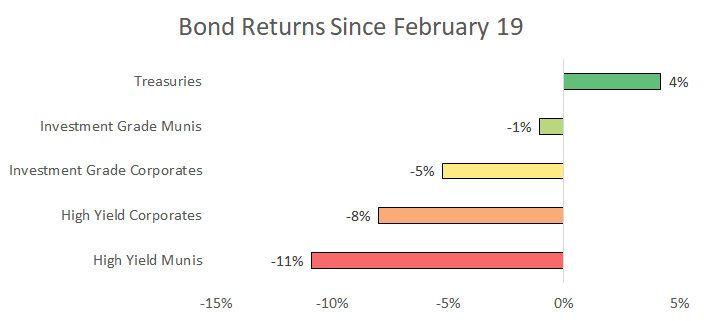

For bonds, this week has been a stark reminder that credit risk can sting.

More conservative bond funds have outperformed riskier peers that were popular during the chase for yield:

I prefer isolating credit risk away from the bond side of my portfolio, so the two main funds I use are VGIT (Treasuries, in tax-deferred accounts) and VTEB (munis, in taxable accounts). This overall stock and bond approach guarantees I’ll never have a +70% year, but it also makes sure the portfolio can always live to fight another day.

#3: Abandoning Discipline (Your Only True Edge)

We’ve all heard a statistic like “$100 invested in stocks in 1950 would now be worth $146,000.”

It’s deceptive because it makes investing look easy. Investing is not easy – that’s why we earn a return for doing it.

“Stocks won’t make you wealthy. Your behavior around stocks makes you wealthy.”Nick Murray

We all know stocks will outperform bonds over the long-term. So why not invest 100% in stocks? Because most people can’t emotionally handle that. Like Ben Carlson said, anyone can build a portfolio. Not everyone can stick to it.

If you’re reading this and invested in a broad market fund then you own a portion of these companies:

You’re a business owner. Now imagine you owned a hotel near the beach and a bad storm is coming. Business will slow down. Are you going to sell the hotel before the storm? No. You know the long-term value of the business isn’t impacted by a short-term event. So why do investors chronically liquidate stocks every correction? Because they can. The luxury of liquidity turns into a curse when people panic.

We all know there’s no shortcut to getting physically fit. You have to put in the time. Investing is the same way, but instead of exercising it calls for mental discipline. How an investor behaves separates those who say “I pulled everything out in 2008 and just never got back in” from those that can look back in a decade and say “Yeah, lots of people freaked out. I didn’t.”

Summary

- Consider more than just an extreme outcome.

- Make sure your portfolio isn’t taking a ton of risk you can’t handle.

- Mental discipline separates winning investors from losers. This is when you have to exercise it.