The Once in a Decade Bond Opportunity

On the low cost of inflation protection and environments where TIPS historically outperform Treasuries.

Last summer I wrote about a mispricing in the bond market in 2008 and wondered if we’d ever see something like it again.

As of March 20th, markets are (once again) giving away inflation protection for next to nothing.

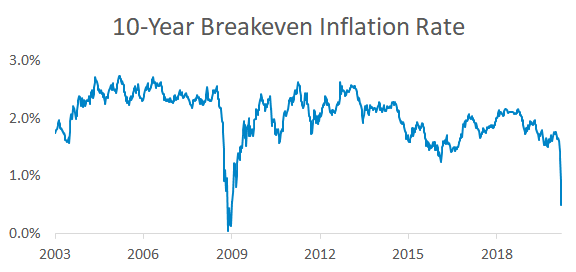

The chart below shows the breakeven inflation rate. This is the level of inflation where Treasuries and Treasury inflation-protected securities (TIPS) will earn identical returns:

If future inflation is higher than the starting breakeven rate, TIPS will outperform Treasuries. With the breakeven rate near an all-time low, TIPS are extremely cheap. TIPS are different than a regular bond in two ways:

- The principal value is adjusted higher with inflation.

- Coupons are based on this adjusted principal.

If you buy a regular bond for $1,000 with a 1% yield, you’ll earn $10 per year in interest and $1,000 back at maturity. But let’s say you buy a TIPS bond and inflation is 2% in the first year. The principal will increase to $1,020. And if the bond yields 0.5%, then you’ll earn $5.10 in interest.

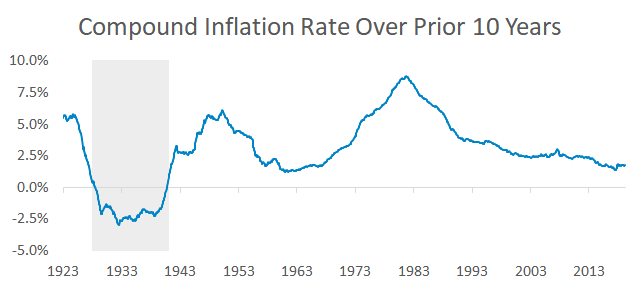

Given current breakevens, a 10-year TIPS bond will outperform a 10-year Treasury if inflation is higher than 0.5% per year over the next decade. The last time this happened was during the Great Depression:

Even if things do get that bad, TIPS have a built-in deflation floor.

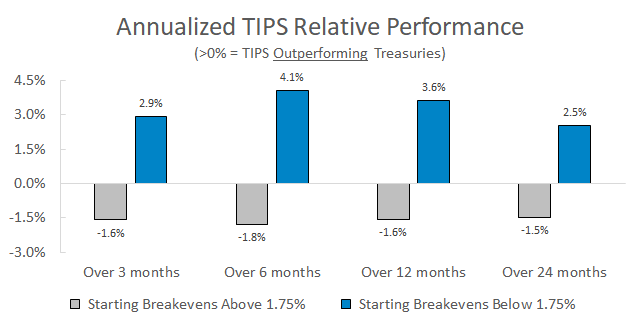

TIPS have significantly outperformed Treasuries following periods of low breakeven rates. When breakevens were below 1.75%, over the next year TIPS went on to outperform Treasuries by 3.6% on average:

The biggest misconception about TIPS is that they’re only worth investing in when inflation is high. As the above chart shows, the main thing that matters is the starting breakeven rate.

Inflation protection is chronically missing in most portfolios I review. If you don’t have TIPS, now is a great time to buy them. Especially in an environment where governments are willing to spend whatever it takes to save the economy:

I personally own Vanguard’s VTIP ETF and it makes up half of the bond exposure in all client accounts.

Summary

- Inflation protection is extremely cheap.

- The 10-year breakeven inflation rate is 0.5% and inflation hasn’t been that low since the 1930s.

- TIPS have historically outperformed Treasuries after starting breakevens were at current levels.