The Misbehavior of Markets Book Summary

Highly improbable events happen in both life and financial markets. The Misbehavior of Markets by Benoit Mandelbrot is about chance, volatility, and how to better prepare a portfolio for the extreme.

Gavrilo Princip woke up with a short to-do list on June 28, 1914: assassinate the archduke. Franz Ferdinand was parading through Sarajevo in a convertible and Princip and his friends were ready. Ferdinand’s route was known in advance and one of the group’s members threw a bomb in front of the archduke’s car. The bomb missed, the parade was cancelled, and Princip headed to a café after the failed assassination attempt.

Later in the day, Ferdinand directed his driver to a hospital to visit innocent victims of the bomb. The driver took a wrong turn. He reversed, the car stalled, and Princip looked up and saw the archduke a few feet away. He shot his pistol and World War I began.

Highly improbable events happen in both life and financial markets. The Misbehavior of Markets by Benoit Mandelbrot is about chance, volatility, and how to better prepare a portfolio for the extreme. Here are my main takeaways of the book:

- Modern financial theory is wrong. Investors aren’t always rational – they can be insane. Investors don’t have the same preferences – an individual has a different portfolio objective than a corporate treasurer. Prices don’t move continuously – they gap up and down. Price behavior isn’t random – it’s dependent on recent history.

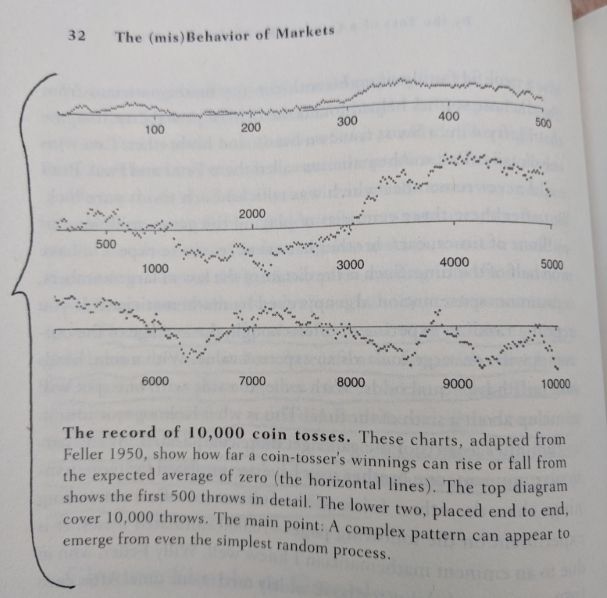

- A complex pattern can appear to emerge from a random series of events. Accepting randomness is uncomfortable, but that’s what most of short-term market action is. Financial media assign meaning and narrative to the noise – not because it’s right, but because a coherent story just sounds better.

- Volatility clusters together. The volatility of the stock market has itself been volatile. Markets alternate between periods of fast action and slow trading. Some years are calm (2017) and some are much riskier (2008). Research has shown that volatility tends to occur more frequently when markets exhibit negative momentum.

- Standard deviation doesn’t accurately measure risk. Markowitz’s modern portfolio theory, Sharpe’s beta, and the Black-Scholes formula are all based on the assumption that prices are normally distributed. The Dow plunged 29.2% on 10/19/1987. Academic formulas said this shouldn’t have happened. Errors emerge when standard deviation is used to calculate the probability of extreme events.

- The equity risk premium isn’t a mystery. Some economists are puzzled by the fact that stocks have consistently outperformed less risky assets. Why does it keep happening when everybody knows that stocks do better? Real investors know better than economists. They know the stock market is very risky and naturally demand (and often get) a higher return. The equity risk premium has historically been stable and positive in the United States. A global history paints a more sober picture – private investors in China and Russia were wiped out when their stock markets fell to zero.

- Skewed distributions are everywhere. Many words in the dictionary are rarely used (alsike, chersonese) and a small few (the, and) are extremely common. The world’s richest 26 billionaires are as wealthy as the poorest 3.8 billion. Market volatility is similar – vast amounts of “regular” punctured by brief periods of abnormal.

- Greater knowledge of danger permits greater safety. For centuries, shipbuilders have put care into the design of their hulls and sails. They know that the sea is typically calm but hurricanes do sometimes happen. Shipbuilders design in case of these storms – despite the construction appearing overkill for the typical day. Mandelbrot’s discovery that prices are not normally distributed means that markets are riskier than previously thought. Most investors are like shipbuilders who ignore extreme weather and optimize a portfolio for the 95% of the time the market is normal.

I really enjoyed this book. You can find used copies on Amazon for $10. And here’s a link to a great interview with Mandelbrot right after the financial crisis.