The Hidden Risk FIRE Investors Miss

An analysis of safe withdrawal rates for early retirees.

The financial independence, retire early (FIRE) movement has gained a lot of traction. “We retired at 30” headlines get clicks and have made people question the typical retirement timetable:

A main goal for those pursuing FIRE is to reach a portfolio balance that can reasonably fund their retirement. This is found by dividing estimated expenses by an initial withdrawal rate that (hopefully) won’t exhaust their savings.

Last year a popular FIRE blogger wrote about withdrawal rates for someone spending $40,000 per year:

Conviction in these numbers stems from the Trinity study. Researchers at Trinity University showed that withdrawing an initial inflation-adjusted 4% from a balanced portfolio of U.S. stocks and bonds survived 95% of 30-year periods since 1925.

Investors have since anchored to 4% as the benchmark safe withdrawal rate for a normal 30-year retirement. But FIRE investors are not normal – retiring at 30 or 40 means a portfolio has to cover 50+ years of spending.

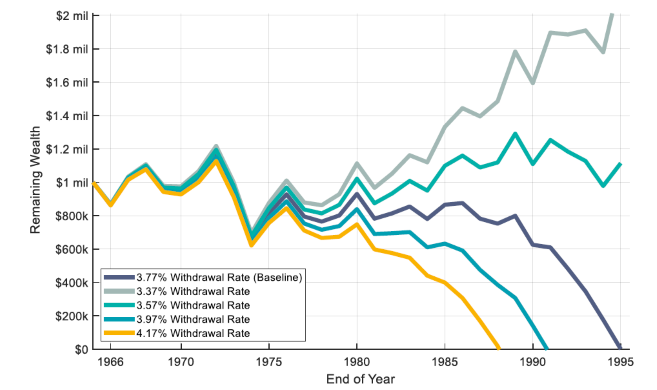

Portfolio values can be extremely sensitive to withdrawal rates. For example, a retiree in 1965 with an initial 4.17% withdrawal rate ran out of money while a 3.37% withdrawal rate resulted in leaving a $2 million legacy:

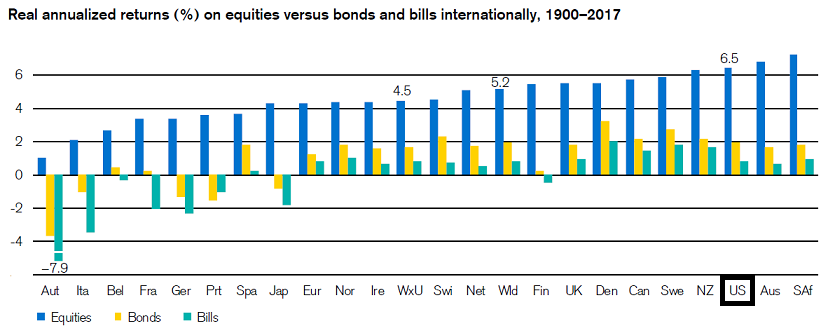

Here’s the big risk: most FIRE blogs calculate withdrawal rate viability only with U.S. data. They’re extrapolating the historical best case of U.S. stock market returns as the future base case.

The U.S. was an emerging market in 1900. Nobody could have predicted that Europe would be devastated by two world wars or that communism would wipe out Russian and Chinese stock investors.

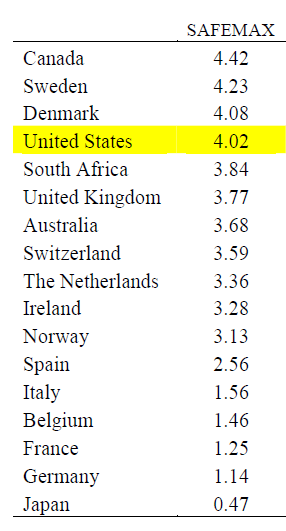

The table below shows safe maximum withdrawal rates (SAFEMAX) for international portfolios over 30-year periods since 1900. I should note that it assumes perfect foresight of the optimal mix of stocks and bonds, so it slightly overstates safe withdrawal rates.

“From an international perspective, the 4 percent real withdrawal rule has simply not been safe.”Wade Pfau

So what’s a FIRE investor to do? Use lower return assumptions. Don’t plan on being able to pick the best performing stock market of the 21st century. Rather than estimating you’ll earn the historical U.S. inflation-adjusted stock return of 6.5%, the global average of 5.2% is more realistic.

It’s tempting to stick with U.S. data. Higher returns translate to higher withdrawal rates, meaning FIRE investors can reach their portfolio goal faster and retire earlier. But a FIRE strategy only based on U.S. data is an overly optimistic guess of what the future will hold.