The Case Against Treasury Bonds in 2020

Treasury yields in 2020 guarantee low returns and a muted ability to hedge future stock downside.

Treasury bonds have been a core holding in client portfolios for years. This post explains why I recently sold all of them.

In 2018 the 10-year Treasury yield reached 3.2%, meaning investors could reasonably expect to earn a total 32% over a decade. In 18 months that return is already 25% since bond values have raced higher as yields imploded.

These returns have been pulled from the future. Imagine somebody owes you $100 per year for ten years. Then in year two they pay $700. You don’t collect any extra money – you just got paid sooner than expected.

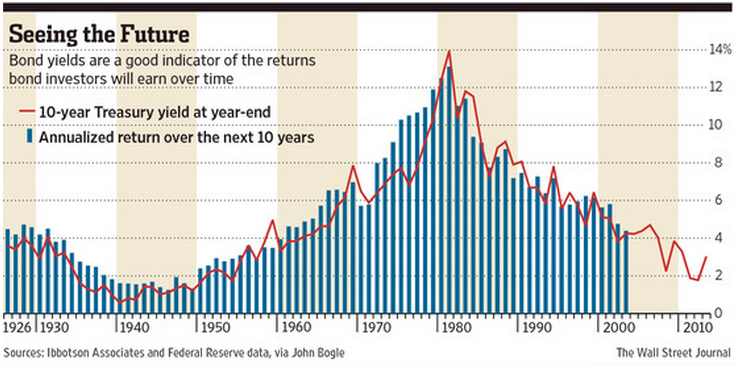

If you know a bond’s yield (red) then you know its approximate future return (blue):

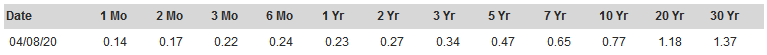

Treasury yields as of April 8, 2020:

Current yields guarantee that future bond returns will not resemble the past.

Despite record low yields, two narratives about Treasury bonds persist:

“Bonds go up when stocks go down”

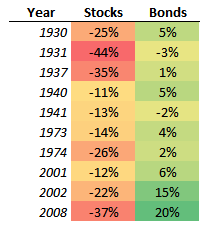

Treasuries provided big returns to offset stock losses in the last two recessions. A long-term perspective shows how unusual this performance was. The table below shows 10-year Treasury returns during the ten worst years for the S&P since 1928:

More often than not, bonds have offered a limited benefit when stocks crash. The 10-year Treasury yield would have to fall to -1.0% for bonds purchased today to match the price gain of 2008. Is that possible? Yes. Is it probable? No.

People always say to me: “This is what works.” I say: “Worked.” - David Harding of Winton Capital

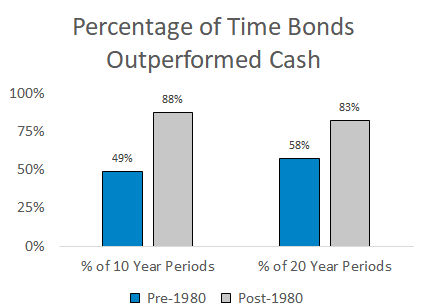

“Bonds outperform cash”

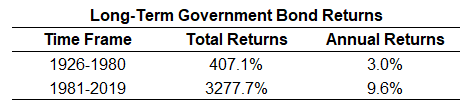

The cash is trash mindset is a byproduct of the stellar bond performance since 1980:

Cash actually outperformed bonds in half of the ten-year periods before 1980:

People say that cash has an opportunity cost. But that opportunity cost is a function of what comparable investments can earn. Rarely has cash (without rate risk) had this low of an opportunity cost compared to Treasury bonds (with rate risk).

I’m not in the camp that thinks interest rates will mean revert to levels from decades ago. But bond investors should acknowledge the risk they’re bearing. For example, 10-year Treasury bond prices would fall 19% if their yield rose to 3%.

My job is to take smart risks, and I can no longer look at somebody with a straight face and say buying Treasuries at these yields is a risk worth taking. They’ve experienced an incredible run and I’m happy to use it as a selling opportunity.

Summary

- Don’t expect Treasuries to offset a big amount of the next stock crash.

- The opportunity cost of cash relative to Treasuries is low.

- Recent bond returns have pulled forward years of yield from the future.