Testing Hedge Performance When Stocks Crash

Hedging sounds smart. But does it work? This post analyzes bonds, gold, trend, and puts during stock market corrections.

Hedging sounds like a smart thing to do. Who doesn’t want stock market upside with less downside?

This post analyzes the performance of popular hedges when stocks correct.

Bonds

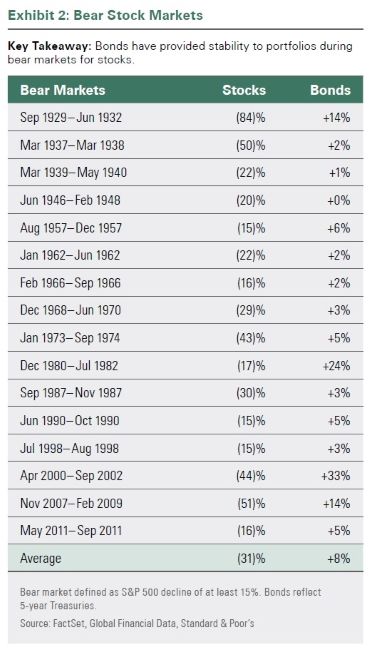

Treasury bonds have been a reliable buffer during bear markets:

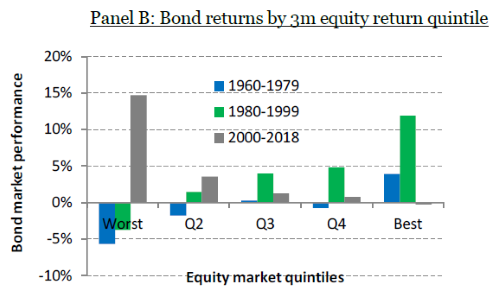

The graph below groups Treasury returns based on 3-month stock performance:

The tall grey bar shows that since 2000 bonds have been unusually strong when stocks have been weak.

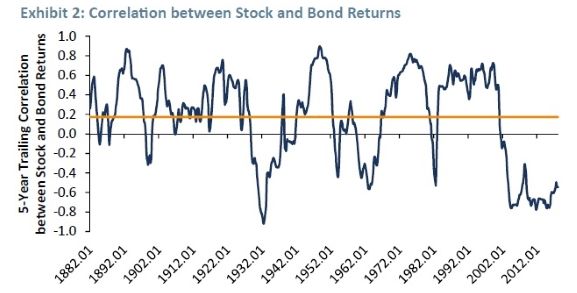

One reason for this is the negative correlation between the two:

Bonds would likely offer less protection in the next downturn if correlations reverted to normal levels. Plus, low yields mean rates would have to approach zero for bond prices to provide the same boost they did in the past two recessions.

Continued low stock/bond correlation and negative rates could happen, but in my mind that’s betting on the improbable. My baseline expectation for bonds is that they’ll provide low single-digit returns during the next recession.

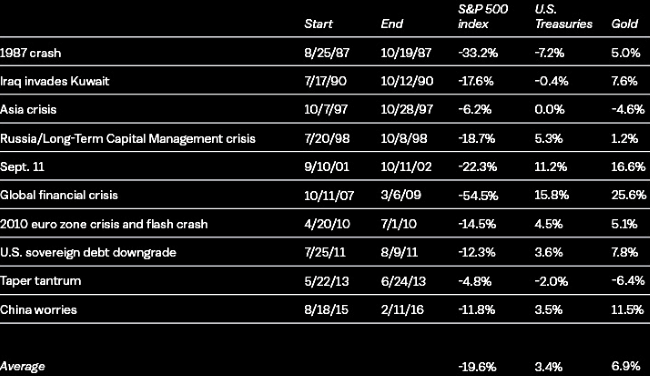

Gold

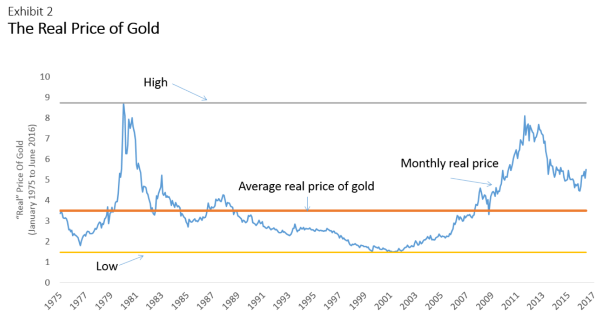

Gold has historically been a solid crisis hedge…

…but with long periods of negative inflation-adjusted returns.

The tricky thing about gold (and most other assets) is that small allocations don’t really impact total portfolio performance.

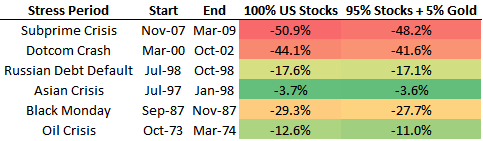

Here’s the historical risk reduction of a 5% allocation to gold:

If you’re going to make a unique allocation you have to do it in size. Small allocations don’t matter.

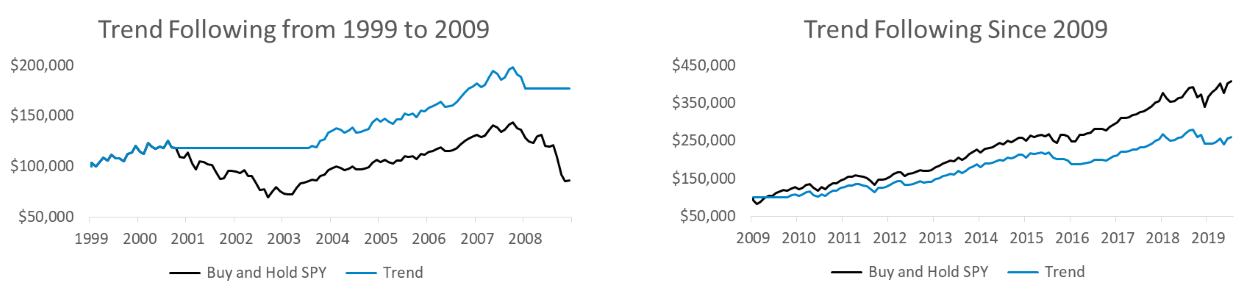

Trend Following

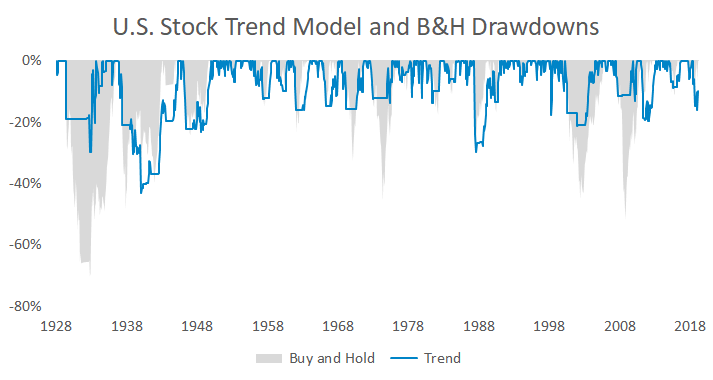

Trend following has done a good job of reducing drawdowns during extended corrections, but not during abrupt crashes like 1987.

The false positives of trend following make investors second guess the strategy when good times persist.

Trend investors feel smart during a crash and stupid during a bull market.

Puts

Puts on stock indices have an advantage over other hedges in that they’re directly tied to what you’re trying to hedge. Investors pay up for this luxury and puts are typically overpriced relative to the volatility that’s actually realized.

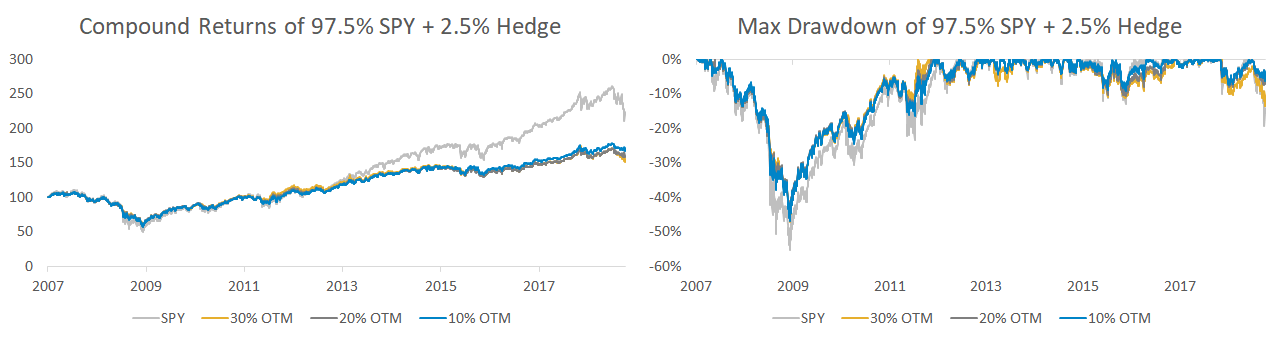

The graph below shows the result of 97.5% in a S&P 500 ETF and rebalancing 2.5% into puts every quarter.

Option protection is reliable but costly. It will bleed an investor dry if their timing isn’t impeccable.

“Purchasing put options to hedge downside risk while maintaining upside participation may sound like it provides a more appealing risk exposure, but it is an exposure that is expected to provide little return.”Source: AQR

Summary

Bonds might offer less protection going forward due to low starting yields and more normal stock/bond correlations.

Gold helps in a crisis but can tread water during calm periods.

Trend following mostly works but can’t avoid quick crashes.

Puts are the most direct way to insure stock risk but earn abysmal full-cycle returns.

There’s always a bull market in talking about a bear market. The holy grail of stock upside without downside doesn’t exist because all hedging solutions are flawed in some way.

Reducing stock exposure is the only guaranteed way to lower stock risk. Stocks will inevitably crash again and investors will scramble for ways to reduce volatility. The time to prepare for a storm is before it happens.

Stocks are 1% from record highs. Now is a good time to get your stock exposure in check, form realistic expectations for what hedges can provide, and remember that there’s no free lunch when it comes to downside protection.