One Portfolio Risk To Rule Them All

Sequence risk is the risk that investment returns happen in an unlucky order. This post shows how to protect against it.

Sequence risk is the risk that investment returns happen in an unlucky order. It can make or break portfolios and this post shows how to protect against it.

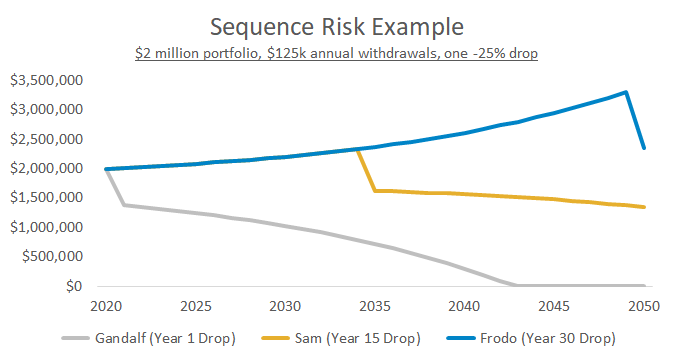

Take three investors that start with $2 million, earn identical 7% annual returns, and withdraw $125k per year. The only difference is that they incur a 25% loss at different times:

- Frodo doesn’t encounter the loss until year 30.

- Sam experiences his loss 15 years down the road.

- Gandalf immediately loses 25%.

The table below shows the compound return and sequence of those returns for hypothetical 30-year retirements starting in 1955, 1968, and 1979. The left-most column shows the safe withdrawal rate, or the initial percentage an investor could have withdrawn without running out of money.

The scenario with the highest 30-year return had the lowest safe withdrawal rate. This resulted in a massively different quality of life. The 1979 retiree with a $2 million portfolio and a 9.1% withdrawal rate could spend an initial $182k per year. The 1968 retiree with a 3.8% withdrawal rate could only spend an initial $76k.

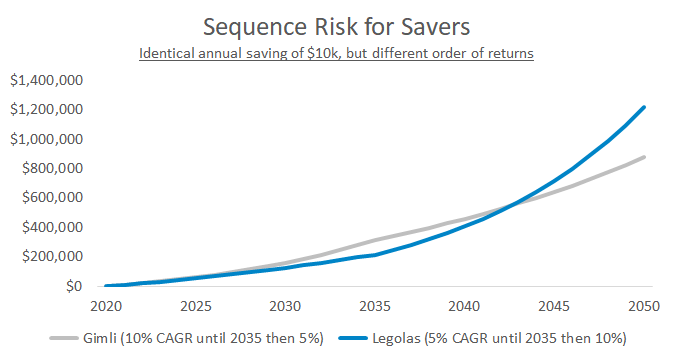

Younger investors aren’t immune to sequence risk. For example, you could encounter strong markets in your 20s and 30s and then lower returns when you’re older and wealthier. Take two investors that save $10k per year for thirty years. They earn identical long-term returns but in a different order:

- Legolas earns 5% per year for the first fifteen years then 10% per year for the rest.

- Gimli experiences the opposite return sequence.

There are four popular strategies to protect retirees against sequence risk. Here are the pros and cons of each:

Strategy #1: Dynamic Withdrawals

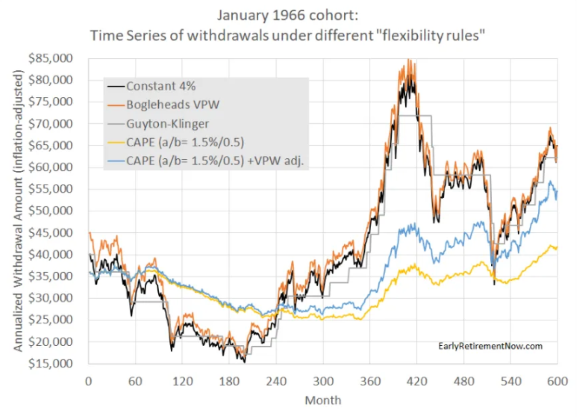

Flexible spending strategies decrease withdrawals after a portfolio falls in value. Two widespread methods are Guyton-Klinger’s guardrails and the Bogleheads VPW.

They both “work” in the sense that they increase portfolio longevity, but they aren’t without risk. Dynamic withdrawal strategies transform sequence risk into lifestyle risk because they can call for steep reductions in retirement spending.

For example, the graph below shows the inflation-adjusted withdrawals of a 1966 retiree. The orange and grey lines show that these strategies led to a 60% decrease in withdrawals:

Cutting expenses by 60% in retirement is not a realistic option for most people.

This approach is most relevant for retirees with a significant amount of discretionary spending. It can also help if a portfolio has done well and you want to adjust withdrawals to avoid living an overly frugal retirement.

Strategy #2: Cash Reserves

Another option is to set aside enough cash so you don’t have to withdraw from your portfolio in a drawdown. Some also call this the “bucket strategy.” A cash reserve does two things:

Reduces long-term returns since cash has historically underperformed stocks and bonds.

Makes an active market timing decision since stocks make up more of a portfolio when you pull from the cash reserve.

The main takeaway from a research paper on cash reserves:

“The results revealed that the failure rates for the buffer zone strategies increased compared to a baseline where there was no buffer zone.”Source: Michael Kitces

While a cash reserve did reduce retirement success rates when taken from the total portfolio, there was little impact if it only came from a bond allocation. Cash and bonds have similar long-term returns, so there’s less of an opportunity cost in replacing bonds with cash.

The main benefit of a cash reserve is emotional, not financial. They help some investors sleep better, and if that means they’re more likely to stick to their retirement plan then there’s merit to using one.

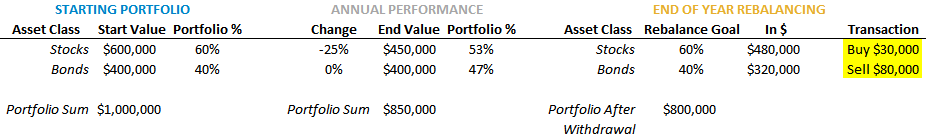

I should note that a cash reserve is not the only way to avoid selling investments when they drop. Regular rebalancing does the same thing. The example below shows how a 60/40 investor needing to withdraw $50,000 would avoid selling stocks if they fell:

Strategy #3: Trend Following

Downside volatility amplifies sequence risk, so one solution is to use strategies that lower the chance of a severe loss. Trend following is one option and has been shown to reduce downside risk over many decades and across multiple assets.

Researchers tested the impact of trend following on retirement and concluded:

“Smoothing the returns on individual assets by simple trend following techniques is a potent tool to enhance withdrawal rates.”Source: Can Sustainable Withdrawal Rates be Enhanced by Trend Following?

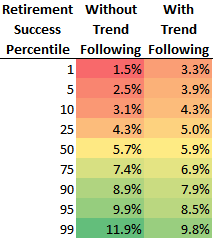

The table below shows safe withdrawal rates for a 30-year retirement with a 50/50 portfolio of stocks and bonds. In the scenarios commonly used to stress test retirement viability (the 5th and 10th percentiles), trend following resulted in higher safe withdrawal rates.

The downside of this strategy is that managing risk can feel foolish.

Nobody pays for home insurance and then regrets that their house didn’t burn down. Portfolio diversification is similar. We diversify because the downside of not doing so is unacceptable, even though we pay a small price for protection when bad things don’t happen.

Strategy #4: “I’m Only Going to Spend Dividends”

This sounds like a perfect solution to sequence risk. If you only withdraw dividends and never touch the principal, how could you ever run out of money? Investors following this approach make two mistakes:

- They assume dividend payments are stable.

- They don’t focus on the only return that matters – total return. A 5% yield is meaningless if the principal is a melting ice cube.

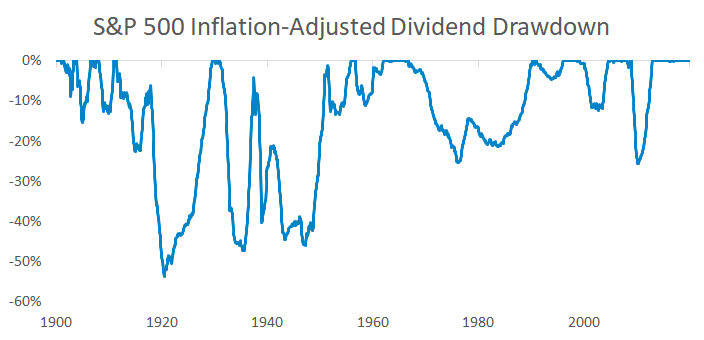

Stock dividends are volatile and have experienced multi-decade drawdowns:

Limiting spending to dividends has the same risk as the dynamic strategy: long periods of lower than expected withdrawals.

Summary

The sequence of your portfolio returns is just as important as the level of those returns.

- Dynamic withdrawal strategies are most useful for retirees with a lot of discretionary spending.

- A cash reserve, when taken from bonds, doesn’t financially hurt and can emotionally help.

- Trend following reduces the chance of a deeply negative return sequence.