Making Money vs. Sounding Smart

Ideas that get the most attention don’t always add value.

Investment ideas that get the most attention don’t necessarily add the most value. We’re inundated with things that sound smart and this post shows how to cut through the noise and focus on what matters.

Example #1: Fund That Sounds Smart

Blackstone’s $8 billion Alternative Multi-Strategy Fund (BXMIX) is a prime example of something that sounds smart to buy.

From its website, the fund “seeks to deliver diversification and volatility mitigation.” It does this through exposure to top tier hedge funds like Two Sigma and D.E. Shaw. The fund is pitched as a satellite allocation to a traditional stock and bond mix:

The underlying hedge fund strategies sum up to a monster portfolio taking up 215 pages:

There’s definitely a lot going on – but does it work?

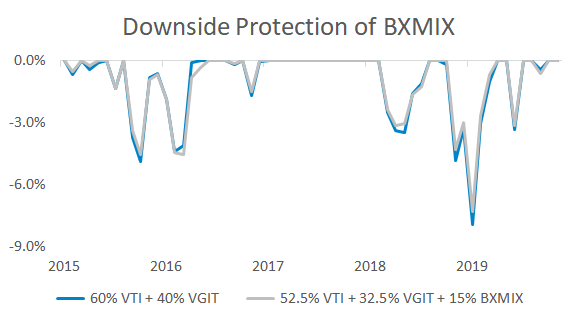

There have been two stock corrections since the fund was launched, giving us an out-of-sample period to test its effectiveness. The chart below compares the drawdown of a 60/40 portfolio (in blue) to the same portfolio with 15% carved out to BXMIX (in grey):

The 15% BXMIX allocation didn’t help.

Access to the “smart money” doesn’t come cheap as the fund charges 2.4%. Investing with a 2.4% fee is like exercising every day and crushing a dozen ice cream sandwiches for dinner. Lots of activity but little progress.

BXMIX is one of many products that sound smart but fall flat. Other examples:

- Fundamental Indexing: Straying from market-cap weighting sounds compelling but these funds have mirrored indices for a decade.

- Volatility ETFs: $1 million invested in VXX at inception would now be worth $97.

- Equity Income Funds: Growth and income sounds like a great combo, but these funds have substantially underperformed the broad market even before their higher tax drag is deducted.

Example #2: Portfolio That Sounds Smart

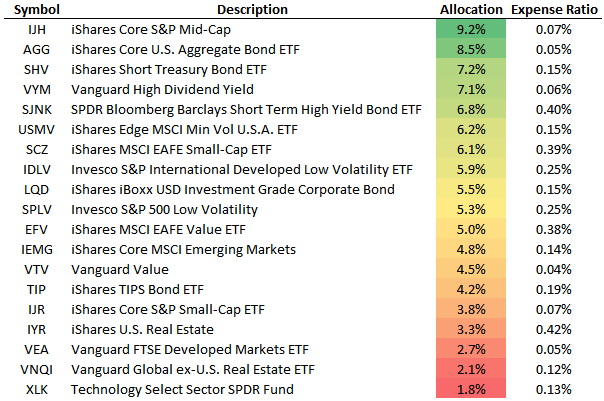

A prospective client wanted a second opinion on this portfolio:

On the surface it looks like the advisor is adding value through tilts to low volatility, small-cap, and value strategies.

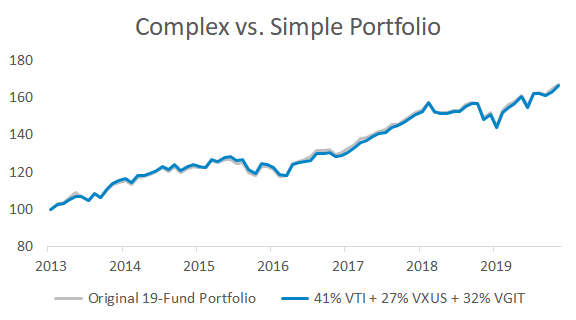

I wanted to see if there was any outperformance over a simplified version aggregating holdings to three major asset classes: U.S. stocks, international stocks, and U.S. bonds.

It’s the same exposure under the hood. Plus, the complex portfolio has a total expense ratio that’s 3x as high as the simplified version.

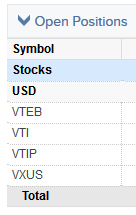

A recent statement for one of my managed accounts:

My strategy uses four ETFs. That’s it.

“Simplicity is the master key to financial success. We ignore the real diamonds of simplicity, seeking instead the illusory rhinestones of complexity.”John Bogle

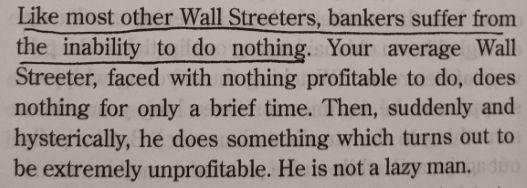

Complexity sells because people who don’t know better think complexity means sophistication. The opposite is true. Simplicity is difficult because investors are bombarded with slick marketing convincing them to do something.

The Real Solution to Complexity

It took me a while to realize that the solution to complexity isn’t managing it better – it’s avoiding it altogether.

There’s a file called “Macro Notes” on my computer. I stopped adding to it years ago:

I thought investing success was a function of synthesizing the firehose of market information. I was wrong.

Less, not more, is the answer. Being a good investor isn’t about having the best data or the longest reading list.

What to Focus On

Things that will make you money and don’t just sound smart:

- If you’re working, increase your savings rate. How much you save matters more than what your portfolio earns. This calculator shows the impact of a higher savings rate.

- If you’re retired, make tax-efficient withdrawals and maximize Social Security. Here’s a handy guide on tax-efficient withdrawals and a free Social Security optimizer.

- Reduce fees. This calculator shows you the true cost of fund fees over the long-term.

- Exercise your investing discipline. Peter Lynch was asked what’s needed to become a great investor and said “In the stock market, the most important organ is the stomach. It’s not the brain.” Don’t let short-term volatility convince you out of a long-term plan.