Lump Sum or Dollar Cost Averaging? Neither – Try VA

The two most common methods of investing fresh capital are lump sum investing and dollar cost averaging (DCA). This post explores a third approach called value averaging.

The two most common methods of investing fresh capital are lump sum investing and dollar cost averaging (DCA). Lump sum means you invest everything at once and DCA spaces out allocations over time, typically into a fixed dollar amount per period.

Michael Edelson wrote about a third approach in Value Averaging. His value averaging (VA) strategy allocates more money after periods of positive performance and less money after periods of poor performance.

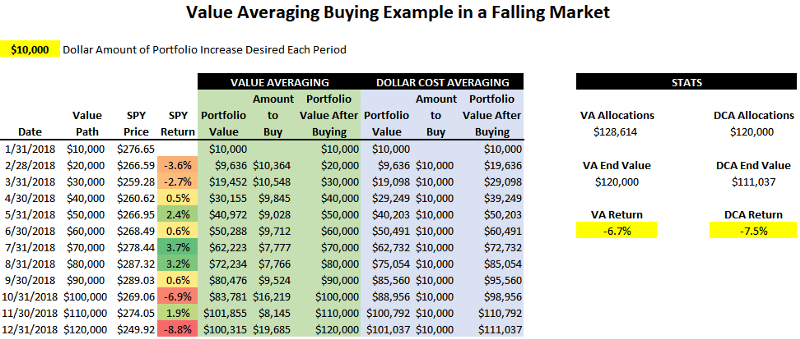

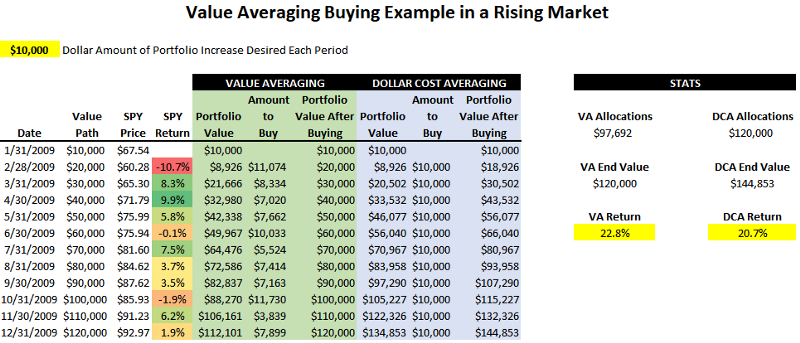

For example, in a period like last year an investor would have ideally allocated less money in Q2 and Q3 (when market prices were higher) and more money in Q1 and Q4 (when market prices were lower). A “value path” is at the core of value averaging. Rather than setting a fixed dollar amount to allocate (as in DCA), a value path specifies a desired portfolio value for a given point in time. Value averaging is effective in both rising and falling markets.

Buying into a Falling Market: The table below shows the S&P 500 (as represented by SPY) from 1/31/2018 to 12/31/2018. In row 1 for 1/31/2018, the first $10,000 is allocated. In row 2, SPY fell -3.6%, so the portfolio value dropped to $9,636. The value path target for row 2 was $20,000. Therefore, a VA strategy calls for allocating $10,364. VA allocations were substantially higher after October and December as the S&P fell.

Buying into a Rising Market: This table features the same setup as the one above, but the date range is from 1/31/2009 to 12/31/2009. I should note that there is a caveat when value averaging: it’s difficult to target an exact amount to allocate given a certain window of time. In the 2018 example above, a VA strategy allocated slightly more than a DCA strategy, and in this 2009 example, VA allocated less than DCA (since the S&P rose in 2009).

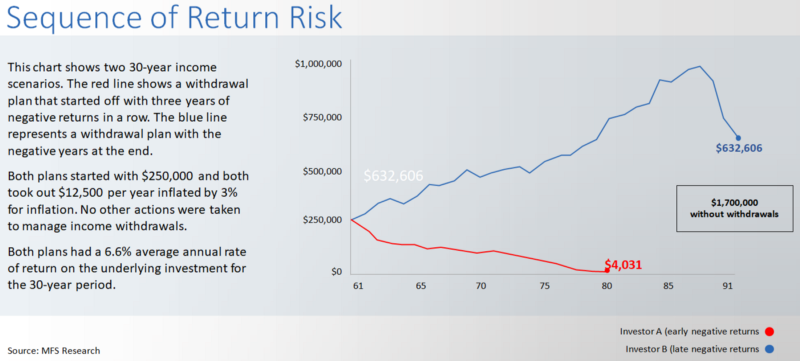

Value averaging is also effective when withdrawing investments. A retiree’s objective should be to raise withdrawals when the market is high and reduce them when low. Being forced to withdraw money after periods of weak performance is related to sequence of return risk. Retirees have a very real risk of retiring at the wrong time, and being forced to withdraw money for expenses after incurring a large drawdown early in retirement can impair a portfolio’s future value.

Value averaging is a way to slightly mitigate sequence of return risk since it lowers withdrawals in a drawdown. It’s worth noting that VA withdrawal strategies are only for investors that have flexibility with their withdrawal schedule.

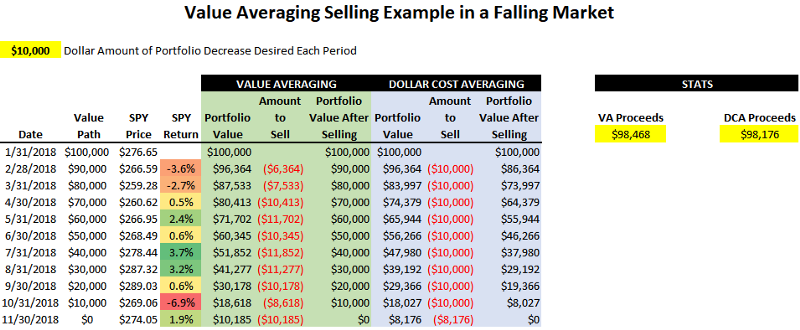

Selling into a Falling Market: The table below is the same scenario as the example for “buying into a falling market”, except that it’s for a value path $10,000 lower per period (and not $10,000 higher when buying).

In summary, value averaging is an effective alternative to lump-sum investing or dollar-cost averaging. I personally use it whenever new clients want to spread out initial allocations over time.