How to Protect a Portfolio Without Market Timing

A new strategy for how to reduce extreme stock market downside and avoid problems with popular market timing approaches.

Capturing stock market upside with less downside is an evergreen goal for investors. When markets rise most people are happy to capture the bulk (but not all) of the upside, as long as they can also reduce downside in years like 2008.

This post introduces a downside protection strategy that avoids some of the issues with popular market timing approaches.

Market Timing: Holy Grail or Hot Air?

There are thousands of unique timing models, but their common goal is to be invested when stocks go up and sell out before they crash. Interest in these strategies spiked after the 2008 financial crisis:

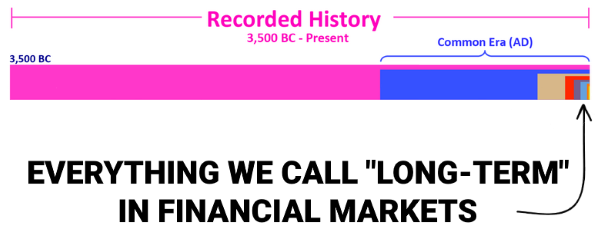

All market timing strategies come with a great story and a better backtest. These investors analyze historical data to find indicators that predicted the past. Unfortunately, past success doesn’t always repeat itself. As Ben Carlson phrased it, these strategies are “experts on a previous version of the world.” Something we label as long-term market behavior today might ultimately prove to be a one-hit wonder.

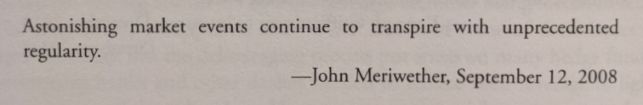

Market timing models assume historical patterns will continue. If I’ve learned anything about markets, it is that they don’t fit an orderly template. The crash this year was unprecedented and I’m sure next year will serve up another surprise. Strategies built for the historical path markets once took are vulnerable if the future doesn’t mirror the past.

Exploring an Alternative

I don’t criticize market timing from the sideline. For years the majority of client portfolios followed a traditional buy-and-hold strategy, but there was also a portion managed with a timing model. Over time I became more critical of the assumptions embedded in market timing. There’s a big difference between what running a tactical model sounds like vs. the actual experience:

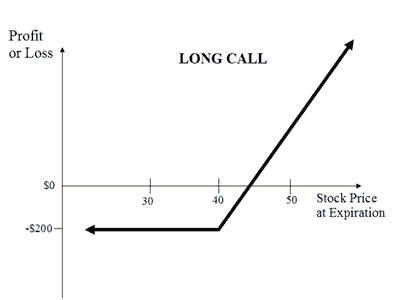

I knew there had to be a simpler way to offer downside protection. The light bulb went off when talking to a friend that asked about in-the-money call options. I said they’re essentially a stock substitute, delivering most of the upside but less downside since they cost less than the stock. The asymmetric payoff of a call option is akin to what market timers chase:

The difference is that market timing strategies only have a “soft stop” on losses. They might signal to exit the market in time – but they might not. Options have a hard stop. You cannot lose more than what they cost. This made me curious if a portfolio of call options could provide downside protection without the complexity or historical assumptions of market timing.

I bought the data, tested the theory, and vetted results with other investors. The rest of the post covers what I found.

Option Structure

The strategy uses call options on SPY, an index fund that tracks the S&P 500. Call options give buyers the right to buy stock at a specific price in the future. I based the strategy on SPY because it provides low-cost exposure to U.S. stocks and offers liquid options.

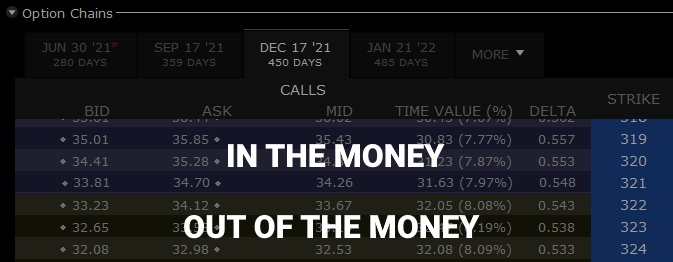

Call options can be in-the-money or out-of-the-money. The SPY fund is currently trading at $322, so a $275 call option is in-the-money since the fund is already trading above $275.

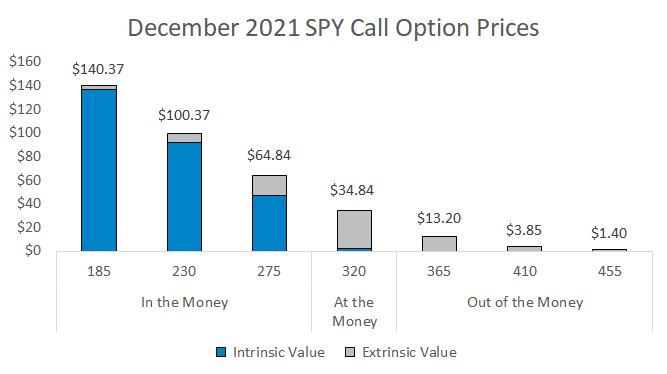

A $275 call expiring next December is currently worth $65. The majority of this option’s price is intrinsic value since SPY is already $47 higher than this option’s strike price. The remaining $18 is extrinsic value. This stems from the fact that investors are willing to pay an additional premium based on time and volatility. Every option has a different amount of intrinsic and extrinsic value depending on how close it is to the underlying security’s current price. Here’s the composition for a variety of SPY calls:

In the context of this in-the-money call strategy, you would want to avoid the extremes of being slightly or deeply in-the-money:

- Slightly In-The-Money: A $320 December call is $35, or 11% of the price of the SPY fund. The option’s lower price means it will provide significant downside protection because it can only lose $35. But there’s no free lunch in markets. This option has a delta of 0.55, meaning it will initially deliver only half of the stock market’s upside.

- Deeply In-The-Money: A $185 December call is trading for $140. This will closely match the underlying stock’s upside since its delta is 0.95. But the high price means there’s less downside protection.

I use call options that are 15% in-the-money. This means buying a $275 call when SPY is $322. The strike price is rounded to the nearest interval of 5 since those options tend to be more liquid. A December 2021 $275 call currently costs $6,484 and represents the right to buy 100 shares of SPY. Buying 100 shares of the underlying SPY fund would cost $32,200.

This strategy provides a high amount of stock exposure without having to tie up a large amount of your portfolio. For example, if someone needed to buy $100k of stocks they could invest $100k in a stock fund. Or they could buy approximately $20k of 15% in-the-money calls that provide a similar level of stock exposure, which frees up money to invest elsewhere.

How to Invest the Extra Cash?

The main priority for the extra cash is principal stability, and bond funds are a natural fit. The bond fund needs to balance two risks:

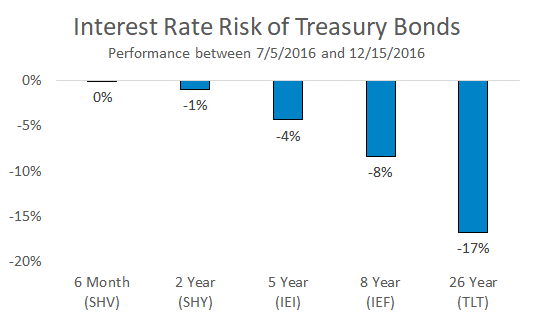

Interest Rate Risk: Long-term bonds are risky when interest rates rise. They’ve recently done well as rates have fallen, but current record low yields guarantee low returns for those taking a high level of rate risk. The chart below shows the difference between short-term and long-term bonds the last time interest rates spiked.

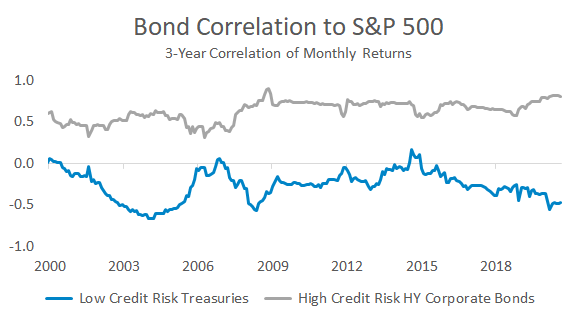

Credit Risk: High credit risk can translate to a higher correlation with stocks. Since the option strategy is already taking credit risk in U.S. stocks, it’s important to avoid amplifying that risk with the bond fund. The chart below shows the difference in stock correlation between a Treasury bond fund with low credit risk and a corporate bond fund with high credit risk.

Vanguard’s BSV is the fund I use. It’s a low-cost ETF that yields more than cash, has low rate risk since it owns short-term bonds, and low credit risk because it mostly owns Treasuries. The options strategy is flexible though, and you could just as easily buy gold, a factor fund, or something else. Just be mindful of the investment’s volatility and correlation to stocks.

Rebalancing the Strategy

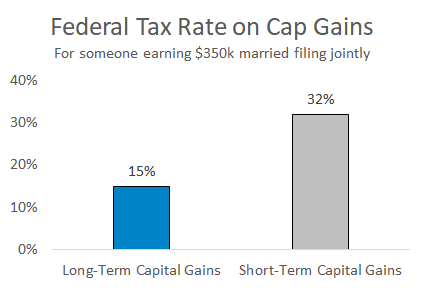

You can’t buy an option and hold it forever since they expire. One solution would be buying an option, holding for six months, and then rolling into a new one. But in taxable accounts this would trigger short-term capital gains.

I designed the strategy to only earn long-term capital gains. Short-term capital gains are a costly byproduct of most market timing models and it’s crucial for taxable accounts to avoid them.

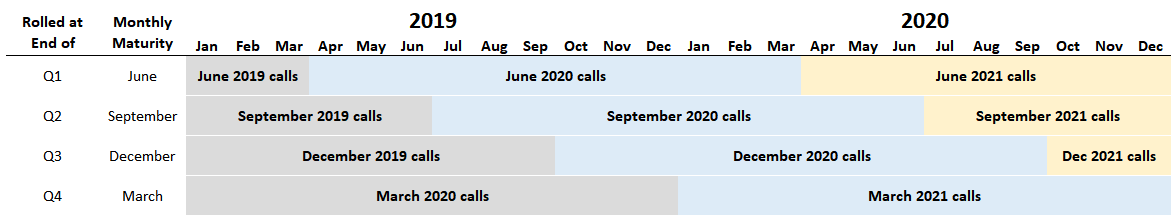

The option strategy buys call options with 15 months to expiration, holds them for a year, and rolls when they have 3 months to expiration. For example, today you would buy December 2021 calls. Then you would hold for a year, sell next September, and buy new December 2022 calls that are 15% in-the-money.

It’s also important to reduce rebalancing luck. Nobody knows in advance the best time to rebalance a strategy. To manage this, the strategy owns a ladder of four options rather than one. One set of the contracts is rolled each quarter. This makes the strategy less sensitive to a single rebalancing date. An example maturity timeline:

Here are two examples of how in-the-money call options performed in positive and negative years:

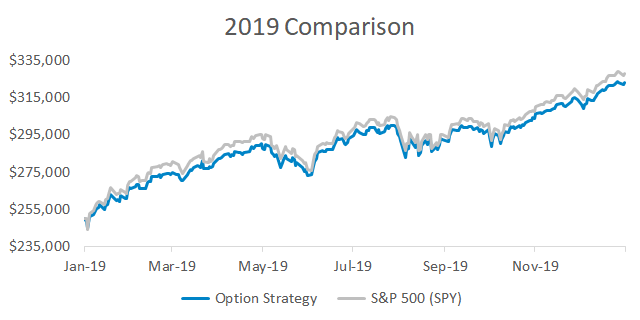

Example #1: Positive Stock Performance in 2019

Let’s say it was January 1, 2019 and your portfolio needed $250,000 in U.S. stocks. You could buy $250k of a fund or use options.

On 12/31/2018 the SPY fund closed at $249.92, so you’d need to buy 1,000 shares for $250k of exposure. In the options strategy you’d need to buy 10 call options. Going 15% in-the-money from the SPY price of $249.92 meant buying $210 calls. For simplicity’s sake in this example I’ll track the price of one option maturity, but four maturities are owned in the strategy.

On 12/31/2018 a $210 call expiring in March 2020 was trading at $49.87. Buying 10 would cost $49,870. Each option has a multiplier of 100 since they represent 100 shares. The remaining $200,130 in cash would be invested in BSV, the short-term bond fund.

2019 was a great year for U.S. stocks and SPY closed on December 31 at $321.86. Buying $250k of SPY made a profit of $71,940 for 1,000 shares and earned $5,619 in dividends. The call option bought for $49.87 rose to $113.15. The option gained $63.28, or $63,280 for 10 options. The $200,130 in the bond fund increased by $9,977 through interest and capital appreciation.

The stock fund gained +31% and ended the year with $327,559. The options strategy gained +29% and ended the year with $323,257. The options strategy captured most of the upside with less capital at risk.

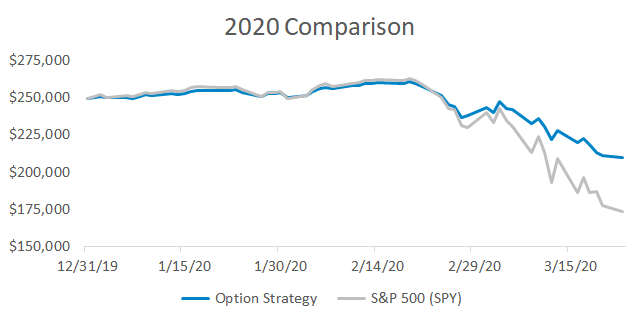

Example #2: Negative Stock Performance in 2020

Now let’s say it was the beginning of this year and you needed $250k in U.S. stocks. On 12/31/2019 SPY closed at $321.86, so if you chose to use a fund you’d buy 777 shares of SPY. For the options strategy you’d buy 8 contracts. Going 15% in-the-money meant buying $275 calls. On 12/31/2019 a $275 call expiring in March 2021 was trading for $57.27. Buying 8 of them cost $45,816. The $204,184 in extra cash would go in BSV.

By March 23 U.S. stocks were down -31% and SPY was worth $222.95. Buying $250k of SPY lost $76,853 and there were no dividends in this period. The call option purchased for $57.27 fell to $5.35. The 8 contracts lost $41,536 and the bond fund gained $1,592.

The stock fund lost -31% and was valued at $173,232 on March 23. The options strategy lost -16% and was valued at $210,056. The options strategy provided downside protection without timing the market.

Historical Performance

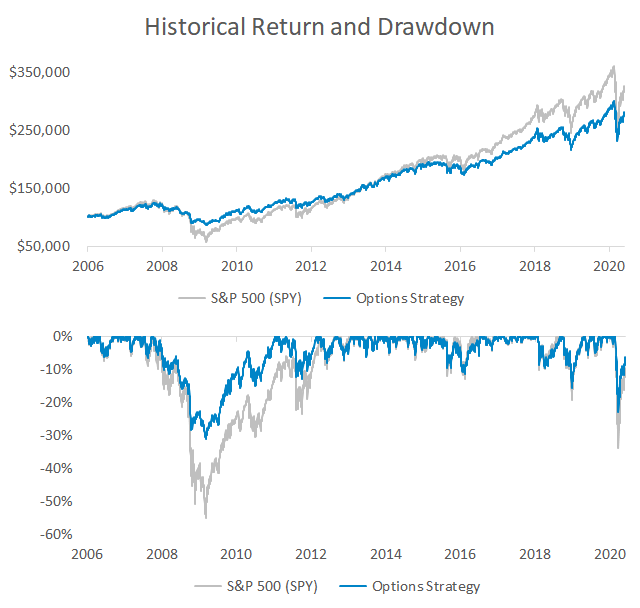

Here’s the option strategy’s simulated hypothetical performance since 2006, when high quality option data became available:

I’ve intentionally made this backtest conservative. The above data assumes all quarterly sell orders are executed at the bid and buy orders are bought at the ask. In actual trading I typically get filled around the midpoint, but I’d rather assume bad price execution and be pleasantly surprised than vice-versa.

I want to be clear that this strategy isn’t perfect. For example, when the market was flat in 2015 it lost 2%. Losing a small amount when the market is flat isn’t great, but it’s a better outcome than the massive lag of timing strategies when the market rises and they’re not invested. The strategy also isn’t meant to hedge every small market drop. The rule of thumb I tell clients is to expect zero downside protection for corrections up to -10%, some protection up to -20%, and a lot of protection for crashes greater than -30%.

Options are typically used as a vehicle for speculation. I’m not doing that. Similar to how some investors own a ladder of individual bonds for fixed income exposure, I own a ladder of options for U.S. stock exposure. The options strategy is one component of a diversified portfolio that (for me) includes international stocks, inflation-protected bonds, and regular bonds.

This strategy is most useful for two types of people:

- The Worried Retiree: Older investors that are more concerned about staying rich than getting rich.

- The Investor Who Never Got Back In: If you’ve been sitting in cash for years and don’t want to put a ton of your portfolio into the market, this strategy provides a capital efficient way to get upside exposure with less risk.

Summary

Most investors build their portfolio based on what they think they know. There are a countless number of strategies designed to look great on the shallow history of financial markets. Are we really sure those patterns will persist?

This strategy takes the opposite approach. I don’t know if valuations will mean revert, if historical indicators will keep working, or if we’re in a new era of constant Fed intervention. All I know is that if stocks go up I want to capture most of the rise and if they collapse I want some protection. That is what the option strategy delivers. Get in contact if you have any questions.