How to Avoid Country Club Syndrome

This post evaluates popular sophisticated products marketed to wealthy investors.

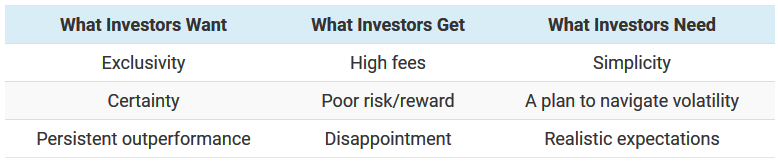

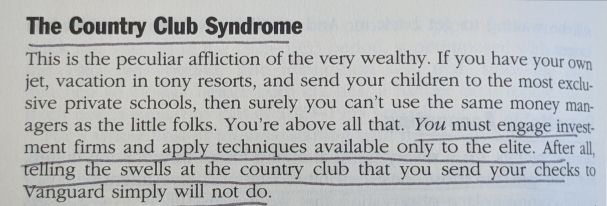

William Bernstein defined country club syndrome as:

This post analyzes the performance of three popular investments that sound sophisticated.

Structured Products

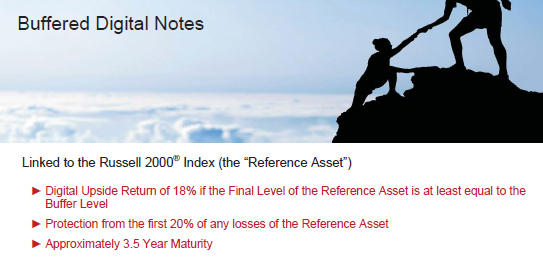

Maybe you’ve seen a PDF like this:

This is for a structured product. One popular variety combines exposure to an asset like the S&P 500 with derivatives that alter its upside and downside. Banks sell structured products to raise cheap capital – not to hand out a free lunch of more return with less risk.

Researchers analyzed 20,000 of these products from 2007 to 2014. On average, they returned -3% per year compared to +4.5% from bonds and +6.1% from the S&P 500.

Structured products are designed to exploit our behavioral biases. They give investors exactly what they want: certainty over future returns. But certainty comes at a steep cost. Engineering Lemons found that yield-enhanced products, a type of structured product, “charge 7% in annual fees and subsequently lose 7% relative to risk-adjusted benchmarks.”

Defined Outcome ETFs

Defined outcome ETFs are a new twist on structured products. The pitch of downside protection and ETF liquidity has resonated with investors and raised $1.7 billion in a year.

The ETFs have a fixed downside buffer with an upside cap that changes based on volatility. For example, the latest December 2020 ETF protects against the first 9% of losses but will not return more than 13.35%. Hypothetical returns for three scenarios:

| S&P 500 Price Scenario | Defined Outcome ETF |

|---|---|

| +30.00% | +13.35% |

| 0.00% | 0.00% |

| -30.00% | -21.00% |

It seems like the +13% and -9% thresholds capture most market environments, but only 35% of annual S&P 500 returns since 1928 have fallen in this range. Average single-digit market returns are not normal and investors chronically underestimate the true range of returns.

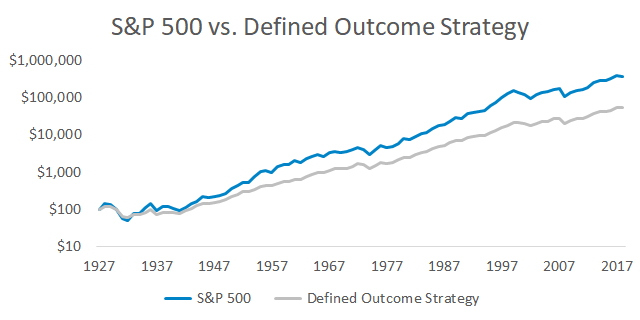

Let’s test a defined outcome strategy on historical data. Since current volatility is below average, to be fair to the strategy I tested a more normal upside cap of 18% with the fixed 9% downside buffer:

The defined outcome strategy underperformed the market by 2% per year.

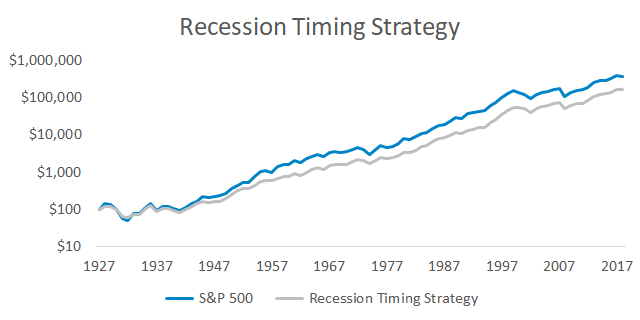

A fair rebuttal would say that these products are only meant for late cycle environments. So let’s test that too.

Imagine you’ve got a crystal ball and can switch into a defined outcome strategy every year before the U.S. goes into a recession. For example, the last recession was from December 2007 to June 2009. The crystal ball strategy would use the defined outcome fund from 2006 to 2009 and switch back to regular U.S. stock exposure at the start of 2010.

Same story of underperformance.

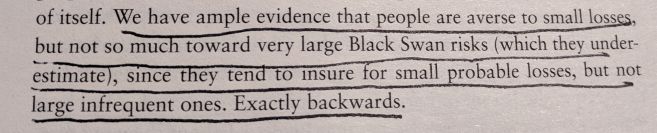

I think a flaw with this approach is that it hedges for the wrong type of risk:

When asked about defined outcome ETFs compared to structured products, Larry Swedroe summarized it best:

“These are a better version of a bad idea.”Source: Bloomberg

Hedge Funds and Liquid Alternatives

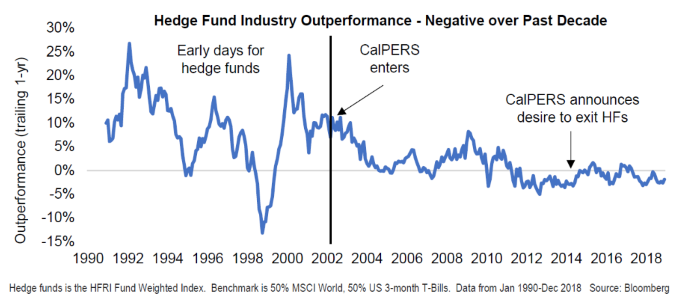

Hedge fund popularity since the 2000s has been an Achilles heel for performance. There’s been less alpha to go around as assets have swelled and manager competition has increased:

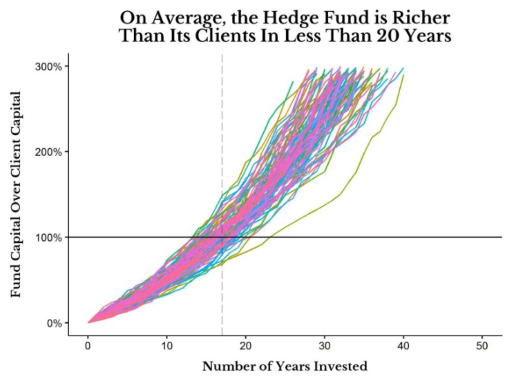

The real money in hedge funds is in their fee structure. There’s a powerful asymmetry in earning performance-based fees in good times but not paying them back after poor returns. Nick Maggiulli found that an example hedge fund fee structure would earn more than a client’s total investment in twenty years:

So why do wealthy investors keep allocating to hedge funds? Meir Statman says:

“Investments are like jobs, and their benefits extend beyond money. Investments express parts of our identity.”Source: What Investors Really Want

A Rolex doesn’t tell time better than a Timex and a Gucci bag doesn’t hold stuff better than a purse from Target. Designer goods convey status and some people want the same from their portfolios.

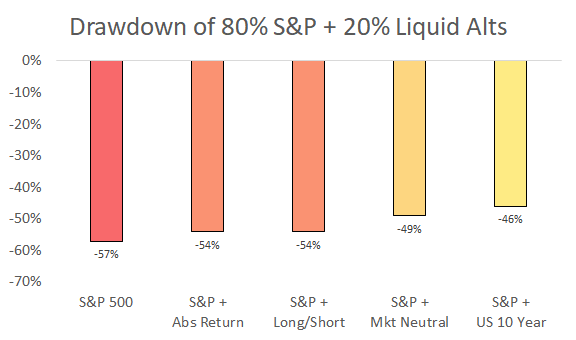

Liquid alternatives aimed to fix two main issues with hedge funds: high fees and low liquidity. They’ve succeeded from a marketing perspective in raising $300 billion, but their ability to diversify a portfolio and reduce risk has disappointed:

Joachim Klement measured the returns of 15 different liquid alt investment styles from 1994 to 2014. Monthly alpha for all categories was negative and median fees ranged from 1.2% to 2.2%.

Morningstar found that fees are one of the strongest predictors of fund success. It will be a perpetual uphill battle for strategies like liquid alts that charge 20x to 30x the fee of traditional assets.

Summary

The merit of an investment strategy isn’t proportional to its complexity or how well it’s marketed.

Another trait of these products is that they capitalize on a general fear of the stock market.

Are you young? Then you should hope for stocks to drop since you’ll be able to buy more at lower prices.

Are you retired? You’re likely overestimating the impact of a stock market correction on retirement plan viability.

I think people forget that investing is about taking risk. If you spend all of your time minimizing risk you’ll also minimize your return. I’m not saying to go full tilt with risk. But if you’re worried about volatility, go direct to the source and reduce stock exposure. Don’t add in a high fee product with a 200 page prospectus.