Book Summary of The Crisis of Crowding

Risk typically stems from concrete things we can point to, like recessions or political change. Crowding behavior is less visible and this book explains how it amplifies market volatility.

The Crisis of Crowding explores how crowding and leverage were at the root of the financial crisis and the fall of Long-Term Capital Management (LTCM). Here are my takeaways of the book:

Crowding is an underappreciated risk factor. Portfolio managers have an incentive to mimic other investors. They look foolish if they miss the bandwagon, but if they lose money with everyone else it looks normal. The issue with crowding is that it can change an investment’s behavior. A strategy that nobody knew about twenty years ago will act differently if everybody starts chasing it. There’s currently evidence of crowding (of varying degrees) in gold, private equity, and low volatility stocks.

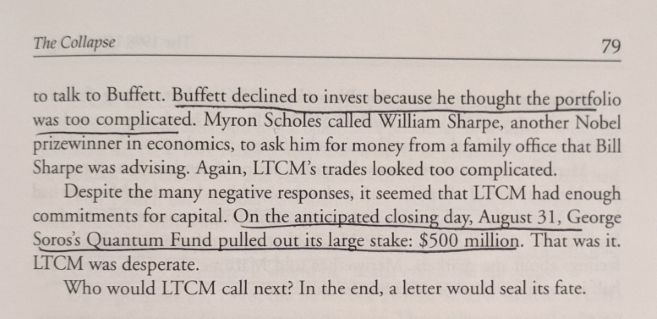

The true story about LTCM. There’s a lot of misinformation about what happened to the biggest hedge fund of the 1990s. The facts:

- Origin: John Meriwether led a bond trading desk at Salomon Brothers that made more than the investment banking, asset management, and other divisions combined. Meriwether and his team split off to form LTCM in 1994.

- Strategy: They exploited small inefficiencies in the bond market. The trades had low absolute returns so the fund used a lot of leverage.

- Track Record: LTCM compounded at 37% per year gross of fees for three years then lost 90% in 1998.

- Positions: The Russian bond trade gets a lot of attention but it was a footnote. The two biggest losing positions in 1998 were short swap spreads and short stock volatility.

- Who Lost Money: Most investors were forced to exit the fund in 1997. The median investor had a 19% annualized return from inception until close and only 6 external investors lost more than $2 million. Partners, not investors, lost the most.

Leverage can ruin a sound investment. LTCM and Lehman Brothers showed the downside of high leverage. Last year someone approached me and wanted to increase their portfolio’s yield. They liked a REIT ETF and wanted to leverage it 3x. The issue is that when you’re 3x leveraged the investment only has to fall 33% to wipe you out. REITs have fallen more than that multiple times. I don’t use leverage and think the increased risk and interest costs swamp the benefit for most everyday portfolios.

Factor investors should take heed of 2007’s quant crisis. In August 2007 quantitative equity funds experienced unprecedented volatility, with AQR’s U.S. value factor falling 30%. Like with LTCM, strategy popularity led to a jammed exit door when volatility rose. Factor ETFs have gathered a ton of assets since then and investors should be aware of the risk that crowding brings.

Good communication can’t stop a panic. Lehman Brothers released their Q2 2008 earnings in advance to restore confidence, but investors didn’t believe the numbers and the firm was bankrupt within weeks. John Meriwether wrote to LTCM investors explaining fund volatility but banks demanded more collateral. No amount of good PR can slow down a situation once the crowd makes up their mind.

“Every banker knows that if he has to prove he is worthy of credit, his credit is gone.”Walter Bagehot

Stress tests need improvement. Risk models can’t be based on a narrow window like ten years of data. Two tools I use are Portfolio Visualizer and Blackrock’s Scenario Tester.

Don’t bet on economic experts to predict the next crisis. Forecasts might generate web traffic, but economists have an abysmal track record. Ben Bernanke wasn’t concerned in 2005 because “we’ve never had a decline in home prices on a nationwide basis.”

I really enjoyed this book, here’s a link to its Amazon page.